Equal Housing Lender

When inaccurate credit exists on a credit report for mortgage delinquency, bankruptcy, foreclosure, short sale and extenuating circumstances, there are five entries that can be used in the Fannie Mae Desktop automated underwriting system (AUS).

Loan originators need to know when to use these codes and where to insert them in the FannieMae.com xml loan application when needed.

Entries noted below should be inputted EXACTLY AS SHOWN, with spaces (no underscores), and are case sensitive! Entry information shown for the five codes can be found in the

Fannie Mae Selling Guide under B3-5.3-09, DU Credit Report Analysis (12/04/2019). Freddie Mac does not have a workaround code for these issues.

WHAT Code To Use

Confirmed Mtg Del Incorrect

(Confirmed Mortgage Delinquency Incorrect)

Underwriting when the Credit Report Contains Inaccurate

Mortgage Delinquency Information

- When DU identifies a mortgage delinquency on the credit report and the information is inaccurate, the lender may instruct DU to disregard the mortgage delinquency information on the credit report. This is done by entering “Confirmed Mtg Del Incorrect” in the online loan application and resubmitting the loan casefile to DU. When the loan casefile is resubmitted to DU, the mortgage delinquency information on the credit report will not be used.

- If the lender enters “Confirmed Mtg Del Incorrect”, the lender must document that the mortgage is not currently 60 days or more past due and has not been 60 days or more past due in the last 12 months.

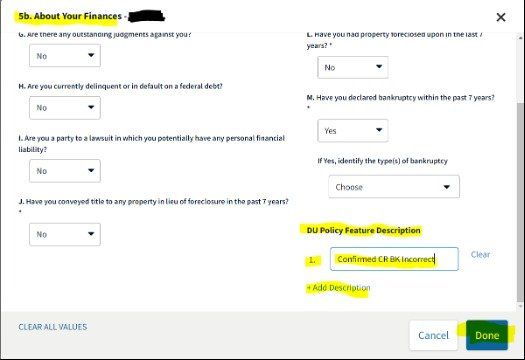

Confirmed CR BK Incorrect

(Confirmed Credit Report Bankruptcy Incorrect)

Underwriting when the Credit Report Contains Inaccurate Bankruptcy Information

- When DU identifies a bankruptcy on the credit report and the information is inaccurate, the lender may instruct DU to disregard the bankruptcy information on the credit report in the eligibility assessment. This is done by entering “Confirmed CR BK Incorrect” in the online loan application and resubmitting the loan casefile to DU. When the loan casefile is resubmitted to DU, the bankruptcy information on the credit report will not be used.

- If the lender enters “Confirmed CR BK Incorrect”, the lender must document that the Chapter 13 bankruptcy was discharged two or more years or dismissed four or more years from the disbursement date of the new loan, or that the non-Chapter 13 bankruptcy was discharged or dismissed four years or more years from the disbursement date of the new loan.

Confirmed CR BK EC

(Confirmed Credit Report Bankruptcy with Extenuating Circumstances[1])

Underwriting when a Bankruptcy Was Due to Extenuating Circumstances

- When DU identifies a bankruptcy on the credit report and that bankruptcy was due to extenuating circumstances, the lender may instruct DU to disregard the bankruptcy information on the credit report in the eligibility assessment. This is done by entering “Confirmed CR BK EC” in the online loan application and resubmitting the loan casefile to DU. When the loan casefile is resubmitted to DU, the bankruptcy information on the credit report will not be used.

- If the lender enters “Confirmed CR BK EC”, the lender must document that the bankruptcy was due to extenuating circumstances, and that the Chapter 13 bankruptcy was dismissed two or more years from the disbursement date of the new loan, or that the non-Chapter 13 bankruptcy was discharged or dismissed two or more years from the disbursement date of the new loan.

Confirmed CR FC Incorrect

(Confirmed Credit Report Foreclosure Incorrect)

Underwriting when Inaccurate Foreclosure Information Exists

- When DU identifies a foreclosure on a credit report tradeline and the foreclosure information on that tradeline is inaccurate, the lender may instruct DU to disregard the foreclosure information on the credit report in the eligibility assessment. This is done by entering “Confirmed CR FC Incorrect” in the online loan application and resubmitting the loan casefile to DU. When the loan casefile is resubmitted to DU, the foreclosure information on the credit report tradeline will not be used in the eligibility assessment.

- If the lender enters “Confirmed CR FC Incorrect,” the lender must then document the foreclosure was completed seven or more years from the disbursement date of the new loan, or that the account was not subject to foreclosure and the loan complies with all other applicable requirements.

Confirmed CR FC EC

(Confirmed Credit Report Foreclosure with Extenuating Circumstances)

Underwriting (Foreclosure) when Extenuating Circumstances Exist

- When DU identifies a foreclosure on a credit report tradeline and that foreclosure was due to extenuating circumstances, the lender may instruct DU to disregard the foreclosure information on the credit report in the eligibility assessment. This is done by entering “Confirmed CR FC EC” in the online loan application and resubmitting the loan casefile to DU. When the loan casefile is resubmitted to DU, the foreclosure information on the credit report tradeline will not be used in the eligibility assessment.

- If the lender enters “Confirmed CR FC EC,” the lender must then document that the foreclosure was due to extenuating circumstances, the foreclosure was completed three or more years from the disbursement date of the new loan, and the loan complies with all other requirements specific to a foreclosure due to extenuating circumstances.

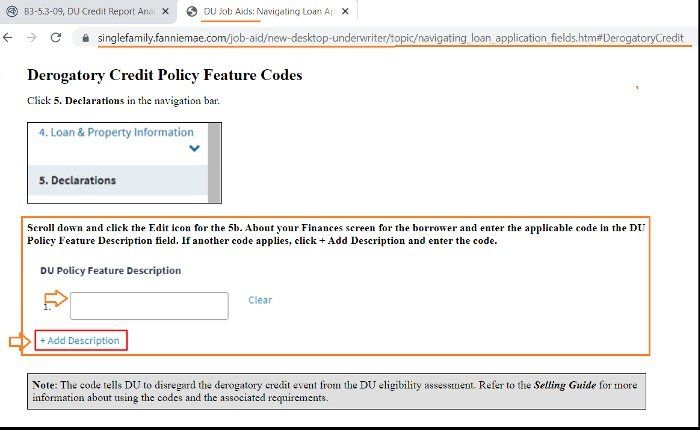

WHERE to insert needed code.

- AUTHOR DISCLAIMER: Some loan operating systems (LOS) DO NOT have spaces between code letters. This may affect the outcome of the AUS decision. The Fannie Mae Job Aid shows where to insert code WITHIN FANNIEMAE.COM and stated that code (in their system) needs to be EXACTLY AS SHOWN in Fannie Mae Selling Guide under B3-5.3-09, DU Credit Report Analysis (12/04/2019) for each code provided.

Fannie Mae Job Aid gives direction on where to insert code in FannieMae.com.

Input needed code directly into xml loan application in FannieMae.com.

In your xml loan application on FannieMae.com, insert code in “5b. About Your Finances” under DU Policy Feature. If more than one code is needed, click on +Add Description to open additional field. Input EXACTLY as code is shown with spaces and is case sensitive! Then click Done.

[1] B3-5.3-08, Extenuating Circumstances for Derogatory Credit (12/16/2014): https://selling-guide.fanniemae.com/Selling-Guide/Origination-thru-Closing/Subpart-B3-Underwriting-Borrowers/Chapter-B3-5-Credit-Assessment/Section-B3-5-3-Traditional-Credit-History/1032990301/B3-5-3-08-Extenuating-Circumstances-for-Derogatory-Credit-12-16-2014.htm

We are looking for up to 10 licensed mortgage loan originators to be part of this pilot. You can be new or experienced. Call Pam Marron at 727-534-3445, email pam.m.marron@gmail.com or use the form below to be considered for the pilot.

Stay tuned.

Writer Pamela Marron is a licensed Loan Originator NMLS #246438 in Florida who works for Innovative Mortgage Services, NMLS #250769 in Lutz, Fl. Articles written are strictly her opinion and are published to help loan originators, real estate professionals and mortgage clients. This is not used to solicit for business.

Pam Marron | NMLS# 246438

Tara Jerse | NMLS# 2105127

Innovative Mortgage Services, Inc. | NMLS# 250769

Equal Housing Lender