Equal Housing Lender

The Silent Credit Crisis Pushing Homeownership Out of Reach

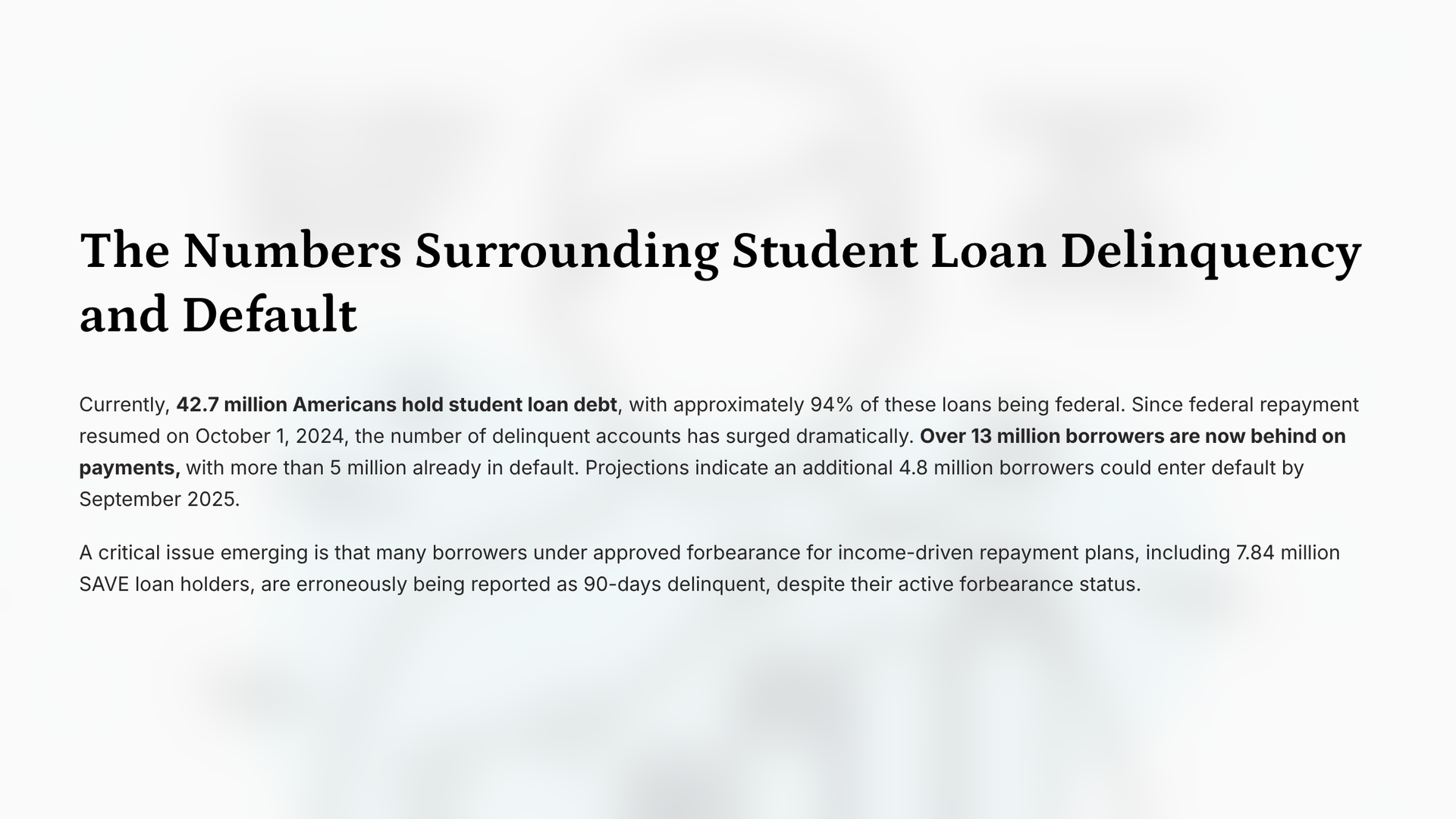

A massive credit crisis is quietly unfolding, and most borrowers—and even some mortgage professionals—don’t see it coming. Due to the 90-day federal reporting rule on student loan delinquencies, millions of borrowers are experiencing sudden, drastic credit score drops—just as they’re applying for a mortgage. Unlike other consumer debt, federal student loans aren’t reported delinquent until the 90th day past due, meaning credit damage doesn’t surface until it’s too late. For many, that delay results in a 100- to 150-point plunge in scores, derailing mortgage approvals and pushing homeownership out of reach for an entire buying season or longer.

Why the 90-Day Delinquency Policy Is a Problem

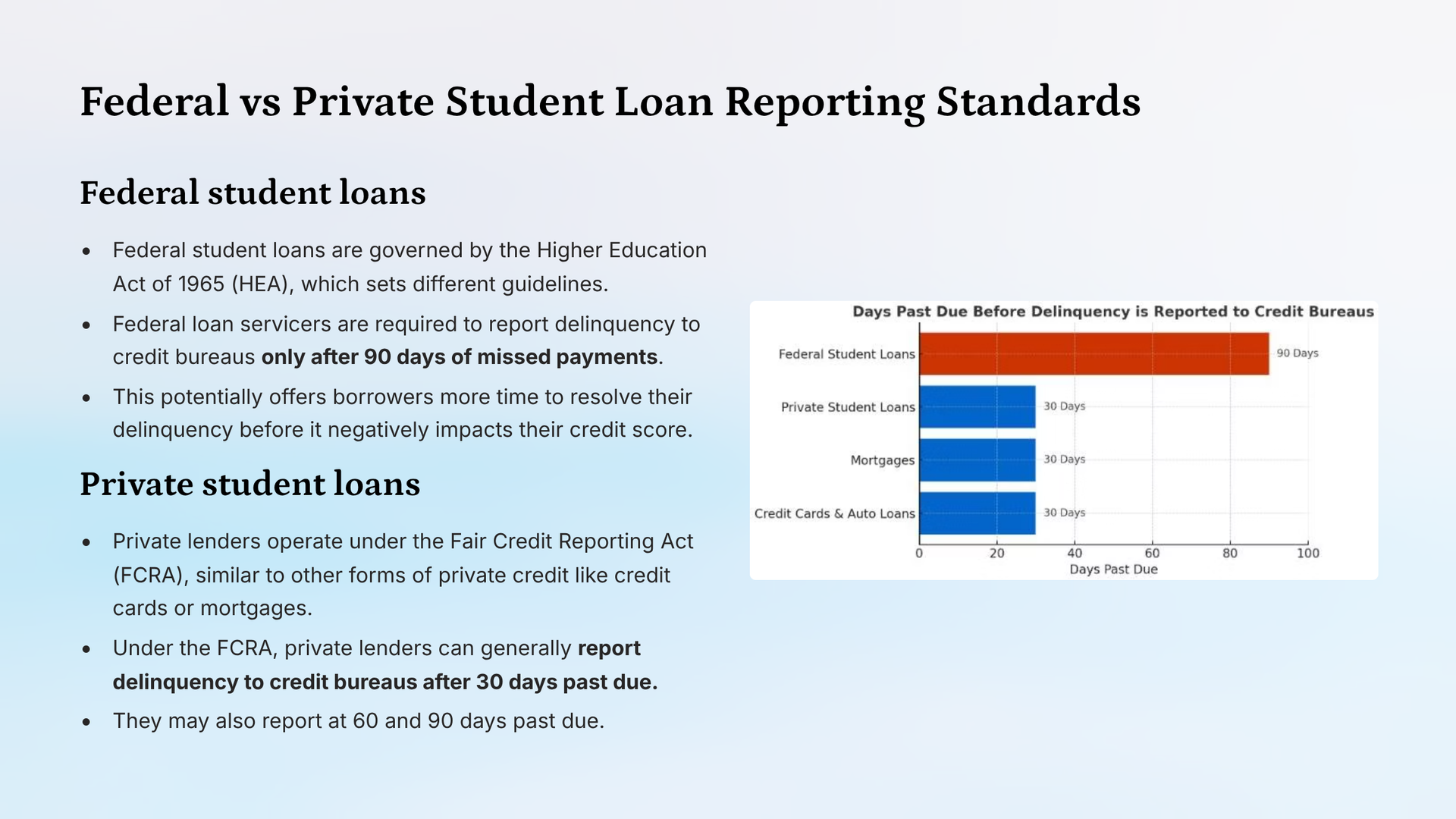

Most creditors—including private student loan lenders—report delinquencies at 30 days past due. But federal student loans, governed by the Higher Education Act of 1965, operate differently. Servicers wait until borrowers are 90 days late before reporting to credit bureaus. While intended as an administrative buffer, this delay has become a liability. Mortgage lenders rely on current credit data, and by the time a federal student loan appears delinquent, a client’s score may have already plunged—without warning. This delayed shock has sidelined thousands of qualified homebuyers who were otherwise ready to purchase.

Even more alarming: many borrowers are in forbearance or eligible for income-driven repayment plans, yet are still reported as delinquent due to servicing issues or communication breakdowns.

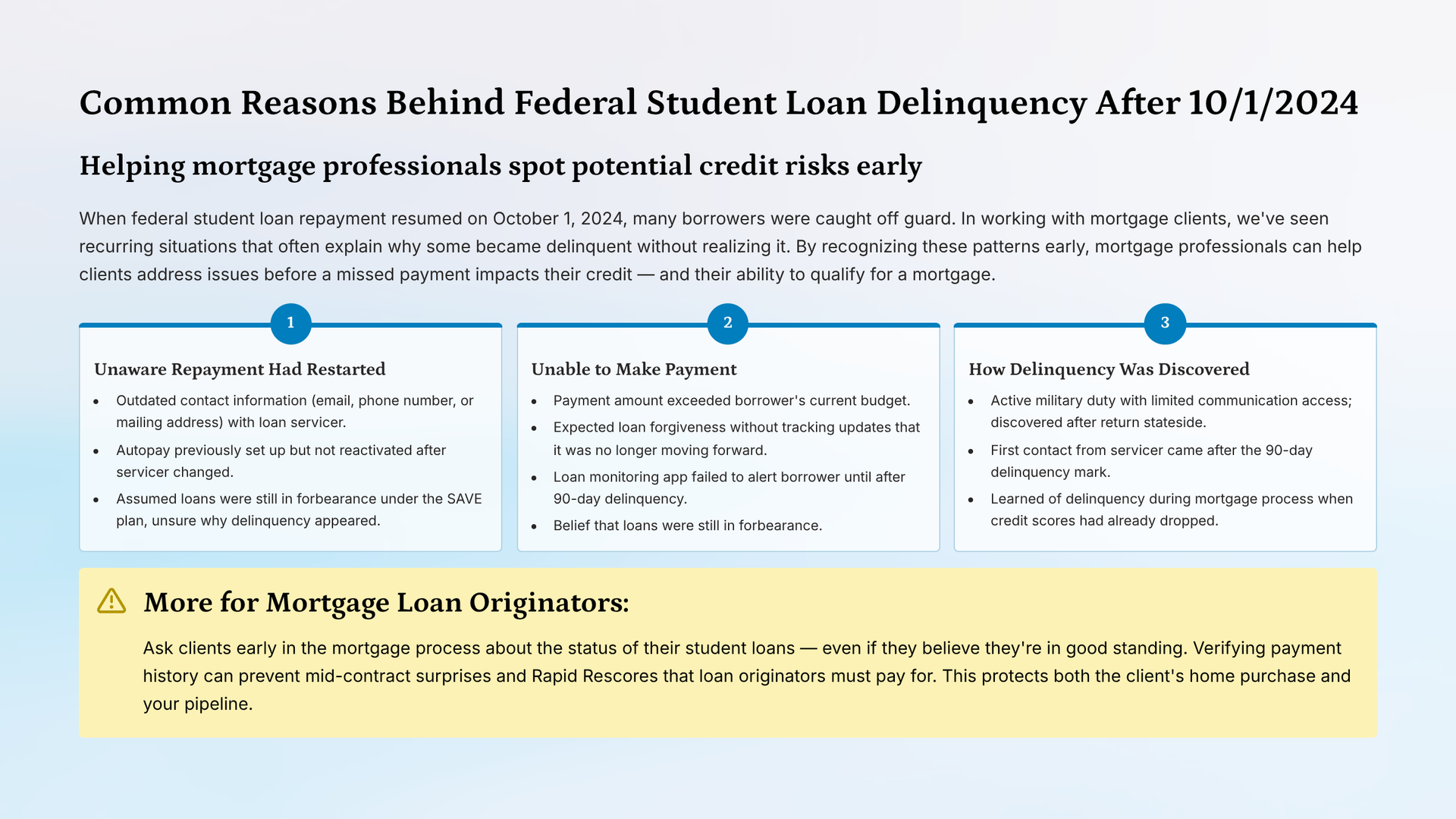

Common Triggers of Unexpected Student Loan Delinquency

Mortgage professionals working with clients affected by this issue often see the same root causes:

- Clients unaware repayment resumed after the October 1, 2024 restart.

- Auto-pay not reactivated with new servicers after pandemic forbearances ended.

- Incorrect assumptions that loans are still under forbearance (especially SAVE plan borrowers).

- Inability to afford payments, made worse by lack of guidance on income-driven repayment (IDR) plans.

- No alerts or communication until 90-day delinquency hits the credit report—often discovered during the mortgage process.

MLOs can’t afford to wait for a credit report surprise. Identifying these risks early can save both the deal and the borrower’s financial future.

Proactive Steps Mortgage Loan Originators Can Take

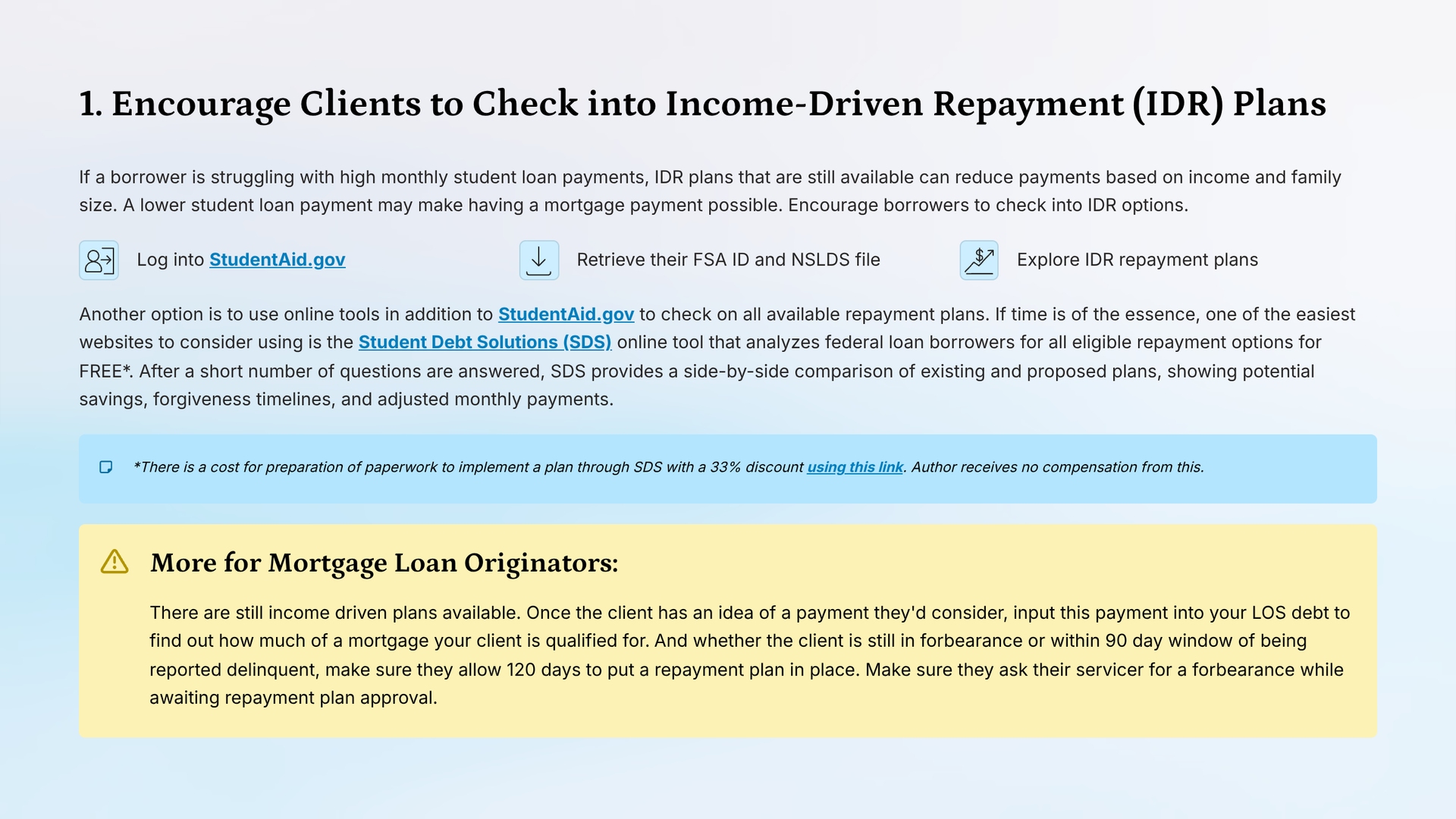

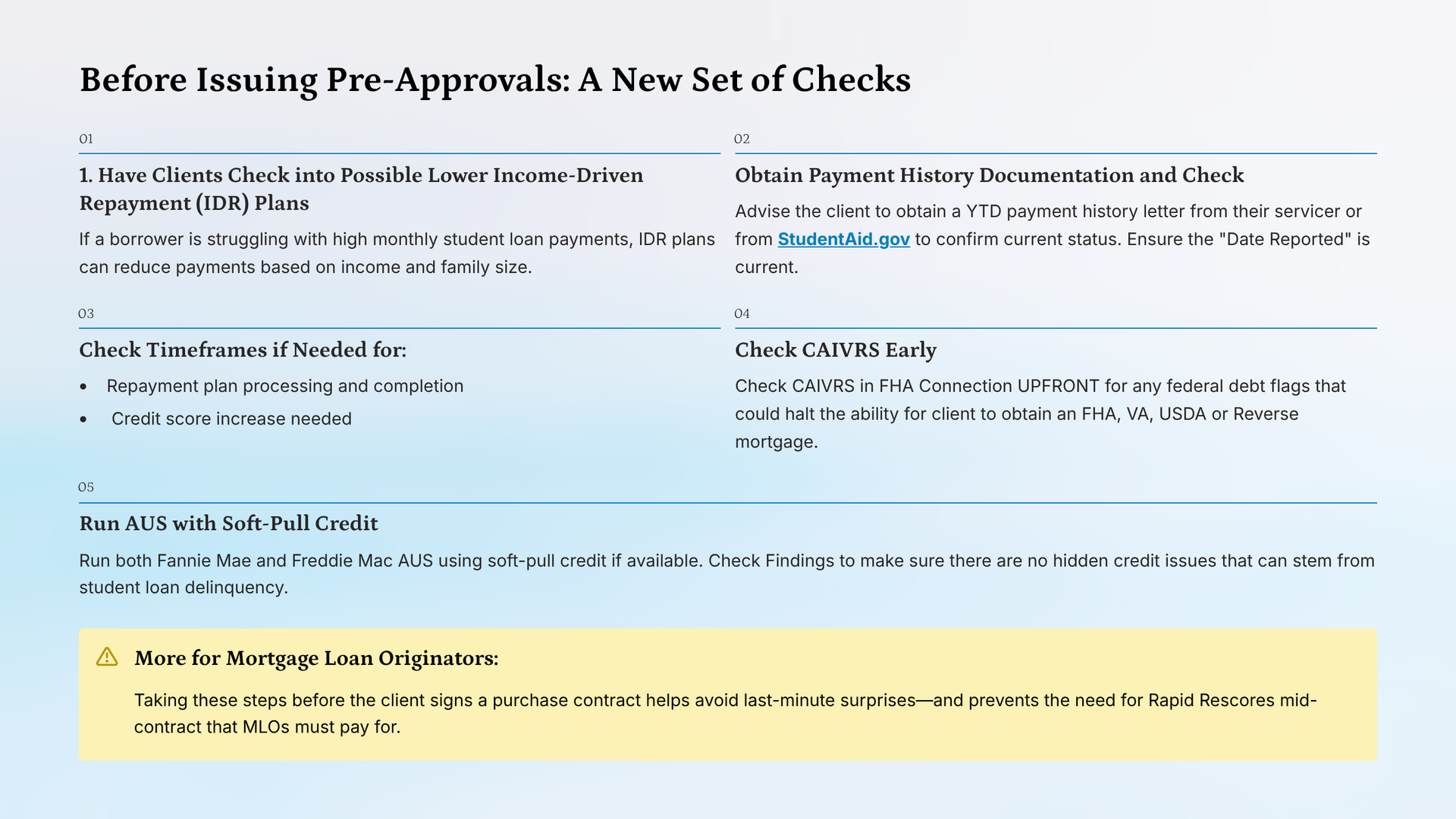

1. Help Clients Explore Income-Driven Repayment (IDR) Plans

Encourage clients to log into StudentAid.gov to explore IDR options that can lower their monthly payments based on income and family size. Lower student loan payments can improve debt-to-income ratios and keep the mortgage application on track.

Tip for MLOs: Also use tools like Student Debt Solutions for a fast side-by-side breakdown of all eligible repayment options. Then plug the new estimated payment into your LOS to calculate improved affordability.

2. Obtain and Review Student Loan Payment History

Help clients gather updated payment history letters from servicers. Make sure documentation includes current status and “Date Reported.” This is especially critical if repayment plans are in process or clients are within the 90-day reporting window.

Tip for MLOs: Advise clients not to go under contract on a home until repayment plans are finalized and documentation is in hand.

3. Use Credit Tools to Strategize Score Recovery

Tools like CreditXpert and FICO Mortgage Score Simulator can help determine how long it will take to restore scores—or if there are faster options. For a recent clientwhose score plummeted from 660 to 520,, checking ONLY on student loan wait timeframe (available with CreditXpert) resulted in a 9 to 15 month wait to increase these scores to mid-620. However, a ratio utilization below 30% on a credit card for the same client resulted in the midscore coming up to a 620 in a much shorter timeframe. These results vary based off of the status of other client credit.

Tip for MLOs: Weigh the time to process a repayment plan alongside the time needed for credit recovery. Share realistic timelines with your clients upfront.

4. Understand CAIVRS and Federal Default Consequences

Once a federal loan is 270+ days delinquent, it enters default—and triggers a CAIVRS alert. This flag blocks access to FHA, VA, USDA, and reverse mortgages until the default is resolved. These clients also face wage garnishment, tax refund seizures, and loss of eligibility for aid or repayment flexibility.

Tip for MLOs: Run CAIVRS checks early—especially when working with FHA/VA/USDA borrowers. Don’t let defaulted loans ruin your client’s loan product eligibility.

5. Run AUS Using Soft-Pull Credit Early in the Process

Run AUS (Automated Underwriting System) for both Fannie Mae and Freddie Mac to detect hidden credit risks—especially student loan issues that may not yet be visible on a credit report.

Tip for MLOs: Run AUS before issuing a pre-approval letter to avoid surprises mid-contract that result in costly Rapid Rescores that the MLO must pay.

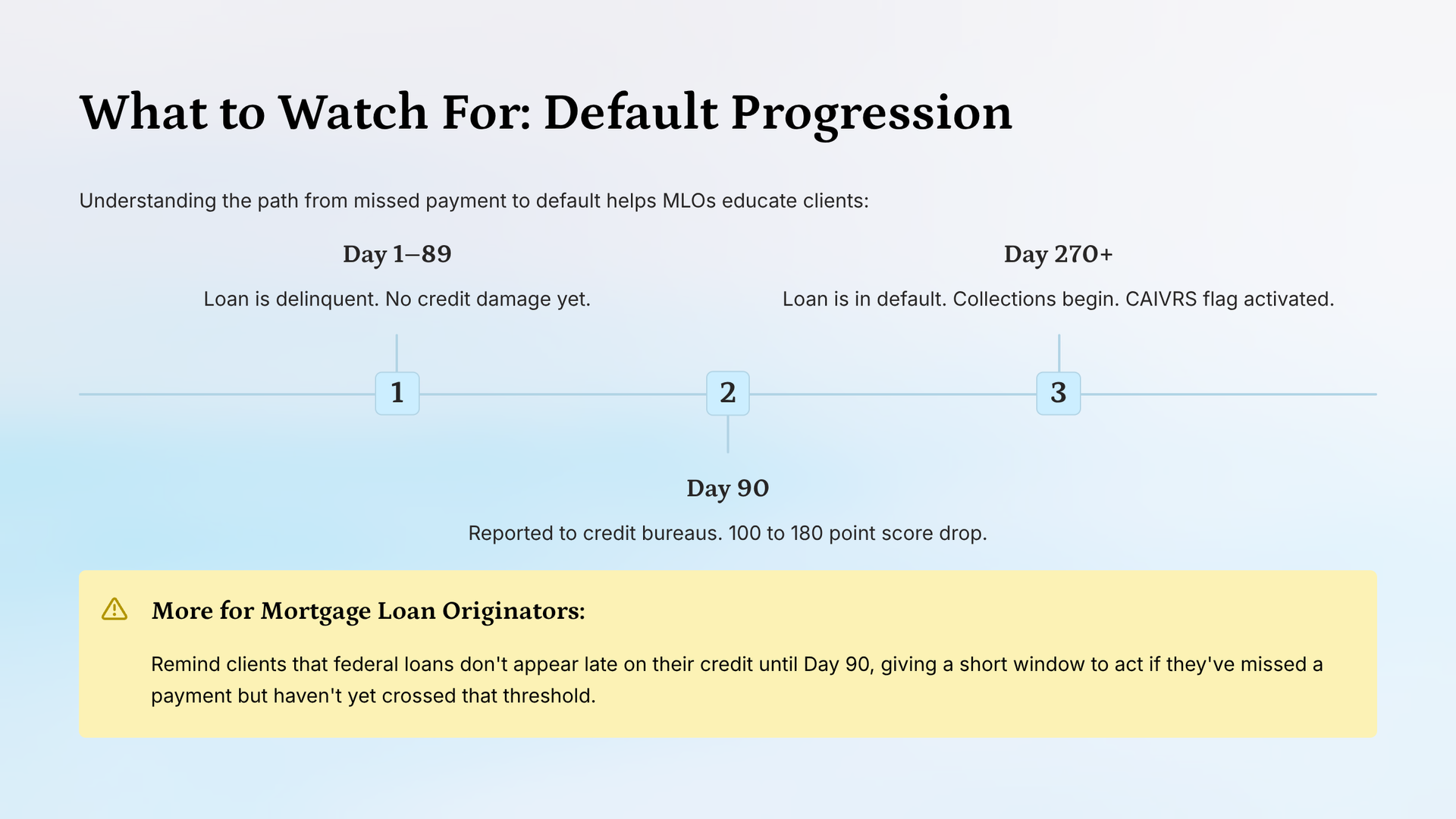

Warning Signs: Know the Delinquency Timeline

Understanding the federal student loan delinquency timeline is crucial:

- Day 1: Loan is delinquent, but not reported.

- Day 90: Major credit hit—scores drop 100–150+ points.

- Day 270+: Loan defaults; borrower becomes ineligible for FHA/VA/USDA loans via CAIVRS flag.

There is a short window for MLOs to intervene before clients face long-term damage.

Help Clients Before It’s Too Late

The warning signs are clear—and we can’t afford to ignore them. The 2008 housing crisis taught us the consequences of neglecting consumer credit risk. Now, federal student loan delinquencies are creating a similar threat.

Mortgage professionals must act now:

- Ask every client about their student loan status—early in the process.

- Guide them to income-driven repayment options.

- Use credit tools strategically.

- Don’t issue pre-approvals until all loan and credit issues are verified.

Helping borrowers navigate student loan repayment isn't just good service—it’s a smart, strategic move that protects your business, your pipeline, and the broader housing market.

Need Help Navigating Student Loan Issues?

📞

Pam Marron

Florida-licensed Mortgage Loan Originator | NMLS #246438

📧

pam.m.marron@gmail.com

??

Clients2Homeowners.com

📱 (727) 534-3445