Equal Housing Lender

"Simplify DPAs: Modernizing Access to Down Payment Programs"

for Innovative Mortgage Services MLOs

Prepared by Pam Marron, Innovative Mortgage Loan Originator, NMLS#246438

with Sean Moss, Vice Pres., Downpaymentresource.com, Down Payment Connect

Guest Speakers

1. 1st mortgage lender that allows 2nd mortgage to be added.

Why are Community 2nds the best?

- Allows client to get the best 1st mortg. rate based off of their credit score.

- Most amount of funds available of all DPA and can be used to buydown rate, the loan amount and reduce LTV to alleviate/reduce PMI on conv loans.

- Most will allow re-subordination of 2nd mtg if client needs to refi in future.

- Most allow stacking of more than 1 DPA.

1st mortgage criteria: Qualify clients with FHA, Conv, USDA guidelines.

- May allow Stacking of additional DPA or grants on top of the 1st mtg. and 2nd mtg.

- FHA, VA, Conv, USDA 1st mortgages allowed.

- Allows seller contribution

- Allows Borrower Paid and Lender Paid

- May allow repair escrow holdback for bank owned property.

2nd mtg. criteria: HUD income level and is based on household income size.

- Often the highest DPA dollar amount available. Can be used towards lowering loan amount, buying out conventional mortg. insurance, buying down interest rate and covering closing costs.

- FTHB requirement commonly.

- Either minimum credit score or allow lower score if AUS approval.

- May have max. front and back DTI ratios unless they allow higher with AUS approval.

- Some have maximum borrower assets allowed.

- Usually deferred for 5 yrs or life of loan, payment not included in DTI.

- May have forgivable option.

- May allow re-subordination of 1st mortgage to allow the client to refinance and keep the 2nd mortgage in place.

- May cap MLO maximum costs.

- Allow seller contribution.

Lenders we can use:

- UWM

- FBC

- Kind Lending

- PennyMac

- Michigan Mutual

- Plaza Home Loans

- PRMG

- Cardinal

- Orion

2. Fl Hometown Heroes/Fl Bond combined 1st and 2nd mtg.

Why is Fl HTH and Fl Bond program the 2nd best?

- One good interest rate for all qualified borrowers no matter what their credit score.

- Qualifying income max. is higher than city and county programs.

- Often Lender Paid points with no point cost to the client.

- Allow stacking of more than one DPA.

- Underwritten and closed by same lender.

Criteria:

- HUD income level and is based on household income size.

- Some Fl Bond prog’s require tax returns.

- Pay a maximum Lender Pd comp to MLO.

- Max. DTI ratio.

- Lower interest rate and one rate per program no matter what client credit score is as long as minimum score met.

- HTH covers 5% of sales price and Fl Bonds cover min./max. $10,000 towards DPA and closing costs.

- FHA, VA, Conv., USDA loans available.

- If refinance, must pay off 1st and 2nd mtg.

- Payment deferred for 30 yrs. or property sold and paid off.

- Cap on Processing Fee, commonly.

- Allow seller contribution.

Lenders we can use:

- FBC

- Windsor

- UWM

3. Proprietary wholesaler combined 1st and 2nd DPA mtg. (incl. grants)

Criteria:

- Underwritten/closed by same lender.

- Only FHA loans.

- No income limit.

- No FTHB requirement.

- Min. credit score as low as 600 with AUS approval.

- Some are forgivable.

- Some may not have deferred payment.

- Often 3.5% or 5% DPA amount.

- Interest rates are higher.

- Both Borrower and Lender Paid pricing.

Lenders we can use:

- Kind Lending

- Michigan Mutual

- Plaza Home Loans

- Orion

- E-Lend (3.5% FHA grant)

4. Other: 2nds, grants, unique benefit DPA

Go to program for income criteria.

- May require DPA 2nd payment to be included in DTI.

- Renovation/repair

- multi-family

- Grants

- Indian Tribes

- Specific business DPA

Programs we can use:

- Solita's House DPA and Renovation DPA with conventional loans

IMPORTANT NOTICE!

When using city, county SHIP and Fl. state Hometown Heroes or *Bond Down Payment Assistance, there are 2 income calculations to calculate upfront for clients!

*Some exceptions apply.

1. Calculate the mortgage qualifying income for the BORROWERS ONLY to get Max. DTI ratio.

Calculate FHA, conventional, VA or USDA income for full-time or variable income using 2 years and year to date average, 1 year and year to date average and year to date average. This gives you the income to input on the mortgage application to qualify with debt for DTI ratios.

In DPA program guidelines or

Down Payment Connect under Borrower Eligibility>Maximum Qualifying Ratios, make sure you are not exceeding maximum ratio allowed.

IMPORTANT! 1st mortgage income qualifying includes rules like inability to include OT, bonus and commission unless that income has been received for 2 yrs. Mortgage qualifying averages income for past 2 years instead of projecting future income. Debt is calculated in mortgage DTI.

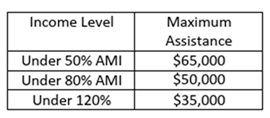

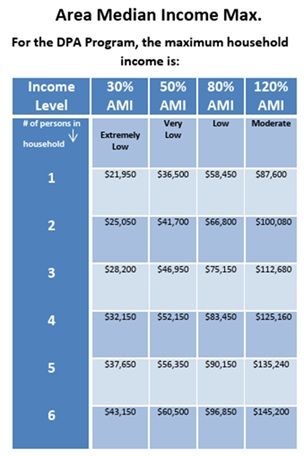

2. Calculate to find out how much 2nd mtg. DPA funds the borrower's household qualifies for.

For all household members over 18 yrs old: average the total gross of paychecks for the last 30 days for borrowers and any household members 18 yrs or older. (Do not gross up non-taxable income.) Multiply this amount by 12 months to equal yearly income.

Compare this yearly income to HUD AMI% the borrowers must be UNDER for their family size. (right).

Then check the $amt of funds available for that AMI%. This will provide the best estimate of what the borrower should receive for DPA assistance.

Example using Pasco County Down Payment Assistance: a 30 yr old mother's income for her and 3 children ages 6,8 and 9 is $68,450. This family of 4 is below 80% AMI (HUD income levels) and qualifies for $50,000 of down payment assistance per table on the left.

IMPORTANT! City, county and State DPA projects income for the future and includes base, overtime, commission and bonus even if not being received for the last 2 yrs!

A word about Variable Income...

A growing number of prospective borrowers have Variable Income where hours fluctuate and are not full-time. Often, overtime, shift differential and bonuses are given. This type of income needs to be averaged and should be increasing. It must generally be received for at least 2 years on conventional loans and can be considered for 12 months on an FHA loan.

MGIC* and Essent (Excel) PMI have Variable Income calculators. Also, UWM has a Variable Income calculator that can be used with W-2s and/or paystubs.

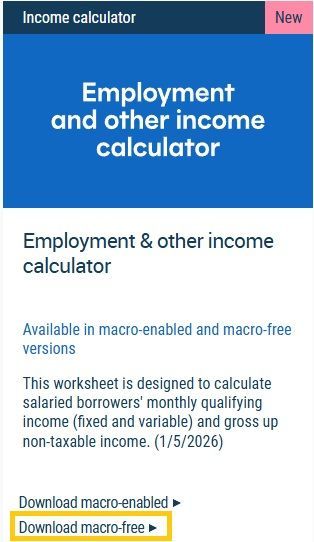

*for MGIC: https://www.mgic.com/underwriting/seb#form, signup and use open Employment and other income calculator: Download macro-free. Picture on right.

Steps below are generic and broad with the intent to "funnel down" to the best DPA programs for your client.

If you find that client income is too high for community 2nds which have the most conservative income levels, then HTH and Fl Bond with higher income levels should be considered. If that income is still too low for clients income, proprietary wholesale DPA is considered as most of these programs don't have an income cap.

Pull Tri-merged Credit

Credit Score Simulation & Improvement

If your client needs to fix a few things on their credit first, CreditXpert analyzes credit data and simulates different actions—like paying down balances or removing inaccuracies—to show how those changes could impact the borrower’s credit score.

CreditXpert can show how scores change after:

- balance is reduced to lower utilization.

- problem account is deleted or paid down.

- disputes are removed.

- # of months goes by.

- an account is added or removed.

CreditXpert is available to MLO’s either through a subscription, your credit reporting agency and also available with UWM through Boost.

- Determine mid-score for borrowers.

- If client has student loans and payment is not shown on credit report, have them get payment letter from servicer.

Analyze 2 Income Calc's for 1st mtg DTI & Community 2nd DPA

Check into 1st option of using city, county or state DPA as a 2nd mtg.

For 1st Mortgage:

- Retrieve last 2 yrs of w’2s and 30 days of year-to-date paystubs. Get employer contact info. for who can verify income for each borrower with a Verif. of Employment (VOE). Send out VOE upfront for clients.

- Avg. 2 yrs and ytd, 1 yr and ytd and ytd income for mortg. qualifying. Use most conservative avg.

For city, county SHIP, state Hometown Heroes and *Fl Bond

- Get 1 month of paystubs for all household members above 18. multiply by 12 months and that is the closest you will get to qualifiable AMI% income.

- Compare this sum to the DPA program maximum income for your client's total # of household members.

*Some Exceptions may apply.

Use DownpaymentResource.com

for FREE to see an overview of what DPA clients are eligible for!

Either you or the client can check this website for most available DPA options other than wholesaler DPA. And its FREE!

- Provides a basic overview of programs (other than wholesale that client is eligible for.

- FREE public facing website.

- Provides DPA in all 50 states.

Additional Benefits of Down Payment Connect: THE BEST TOOL for MLOs & Realtors!

Down Payment Connect, a subscription based program of Downpaymentresource.com, offers has MLOs and realtors detailed information about all DPA in your state!

- Comprehensive information on each DPA with contact info., links to flyers, underwriting guidelines, and a great deal of information not often on DPA websites!

- ALL DPA in your state and a growing number of wholesaler programs (only for MLOs.)

- Incredible filters for what MLOs need to find for clients!

- FREE to many MLS realtors & creates opportunity to partner with them!

- Your own unique anding page to attract DPA seekers to you!

- A front page Directory that shows what type of DPA, max. $ amt and sales price max., if funds are available at-a-glance.

- Ability to keep notes on each program for future reference.

- If community 2nd mtgs will allow re-subordination for future refinance! Not all programs allow this. Noted in Benefits under Program Overview.

- Provides program contacts, Lender Manual, flyers, website, submission portal.

- Provides allowable Homebuyer Ed class options.

- shows which programs allow wholesale, correspondent, retail.

To Be Aware of Upfront...

- Some programs like HTH and Fl Bond have capped 3rd party processing fee which may be lower than your processor normally gets. Be prepared to make up the difference.

- Community 2nds are a totally seperate submission and processors commonly charge for this, approx. $275.

- IMPORTANT: City, county and state DPA use different HUD AMI that has different income levels than Fannie Mae and Freddie Mac, and is based on total income of household members.

- IMPORTANT: Confirm the income calculation method that determines the amount of DPA a client may be eligible for. Most city and county SHIP programs provide different DPA amounts for different AMI incomes but some provide a maximum dollar amount if clients are under a specific AMI%.

Questions below can normally be found on the DPC Program Overview under Application Requirement. If you aren't using DPC, check with DPA provider.

- Does the MLO, realtor need to take a class to get approved BEFORE client can sign a contract?

- Does the client need to get approved UPFRONT with the DPA provider?

- When can a 1st mtg. file be submitted?

- What timeframe is needed by DPA provider to process file to give accurate closing date?

- Does the provider have a maximum cost the lender/MLO can charge?

Stacking DPA

Yes, you can add a 3rd DPA on top of a 1st and 2nd mtg. in some instances!

- Program Directory for each DPA notes if this is allowed under Benefits and Program Terms.

- For your 1st stacking of DPA, make sure that you as the MLO review the underwriting details (you are considering details now for 3 or more programs!) and follow with processor, title co. and DPA provider!

Repair Escrow

Some 1st mortgage lenders will allow DPA for repairs to be used.

- Commonly, only reapirs noted on appraisal can be repaired.

- This is normally allowed when the property is bank-owned or repairs are necessary for safety reasons.

- A cost of 120-150% of the repair invocie cost is commonly held back by the title company until the repairs are done. After a final inspection to insure all work is completed, additional escrow cost can be refunded.

- The seller or the buyer can proivde the cost for the escrow holdback.

Resources

Florida 2025 Hometown Heroes Bond and TBA Guidelines

pardon us while we populate resources!

DPA Articles to Help MLOs

Streamlining the Path to Homeownership: The Benefits of Using HomePrep to get Clients Mortgage-Ready