Equal Housing Lender

Student Loan Articles

Student Loan Videos

Short Term Credit Help | How To & News Articles

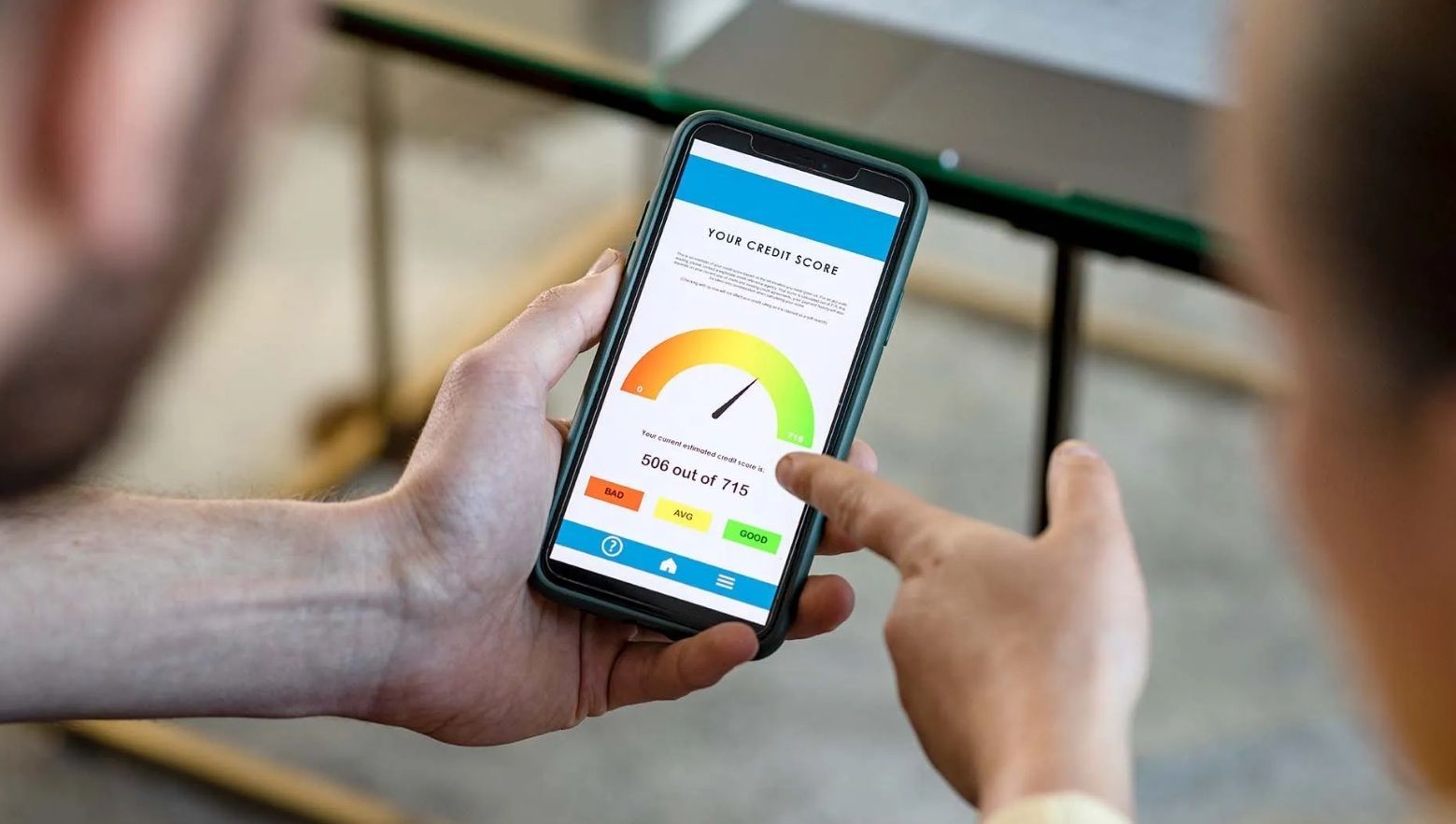

As federal student loan repayments resume, millions of borrowers are facing the very real risk of delinquency. Falling behind on payments can feel overwhelming, but understanding the long-term financial consequences is essential. Delinquency can trigger a chain reaction that affects your credit, career, housing, and overall financial stability.

Long Term Credit Help | How To & News Articles

Streamlining the Path to Homeownership: The Benefits of Using HomePrep to get Clients Mortgage-Ready

Learn how Mortgage Loan Originators (MLOs) can assist clients in overcoming credit, budgeting, and down payment challenges through HomePrep.

For the last four months, efforts have been underway to form a pilot program that can assist mortgage clients who aren’t quite ready to purchase a home to get “mortgage ready”. The model is uniquely laid out to address six issues (other than an expensive housing market!) that mortgage loan originators (MLO) commonly run into that prevent their clients from purchasing a home. The goal of this effort is to make sure that clients are matched with HUD housing and credit counselors who are trained to get clients past hurdles and “mortgage ready” before these prospective home buyer starts looking at homes with a realtor.

Down Payment Assistance How To & News Articles

Streamlining the Path to Homeownership: The Benefits of Using HomePrep to get Clients Mortgage-Ready

Learn how Mortgage Loan Originators (MLOs) can assist clients in overcoming credit, budgeting, and down payment challenges through HomePrep.

Down Payment Connect is already being used by MLOs and Realtors. Now it's available to HUD Counselors through HomePrep! Down payment assistance is quickly rising to the top need for clients wishing to purchase a home. Down Payment Connect , the back-end data provider for the parent Downpaymentresource.com , houses every down payment assistance program in the US and provides extremely detailed information laid out in a consistent format for each DPA program in their system. Throughout the last two years, Downpaymentresource.com administrators have worked with MLO’s and the HomePrep developers to add nearly all wholesale down payment assistance programs to their platform and they didn't stop there! Extensive filters that allow for selection of specific client needs such as type (ie. SFR, manufactured homes, condos, multi-family, ADU’s), uses like renovation, above AMI income levels, non-1st time homebuyers are just a few of the filters you will find along with stand alone 2nd mortgages, combined 1st and 2nd mortgages and grants. DownpaymentResource.com is also in many MLS systems across the US and provides limited directory information and a free landing page for realtors to promote that they use DPA. Both MLO’s and realtors can subscribe to Down Payment Connect to get more of the extensive directory and back-end tools. Now, through HomePrep, HUD counselors can also use the Down Payment Connect system to filter trhough DPA programs that clients are qualified for, and can even provide wholesale programs when working with an independent loan originator (often called a mortgage broker)! Through HomePrep, HUD counselors are now able to provide MLO’s and clients with the DPA programs that they have found the client is eligible for.

Home Prep Now Open! How To & News Articles

As federal student loan repayments resume, millions of borrowers are facing the very real risk of delinquency. Falling behind on payments can feel overwhelming, but understanding the long-term financial consequences is essential. Delinquency can trigger a chain reaction that affects your credit, career, housing, and overall financial stability.

Streamlining the Path to Homeownership: The Benefits of Using HomePrep to get Clients Mortgage-Ready

Learn how Mortgage Loan Originators (MLOs) can assist clients in overcoming credit, budgeting, and down payment challenges through HomePrep.

Down Payment Connect is already being used by MLOs and Realtors. Now it's available to HUD Counselors through HomePrep! Down payment assistance is quickly rising to the top need for clients wishing to purchase a home. Down Payment Connect , the back-end data provider for the parent Downpaymentresource.com , houses every down payment assistance program in the US and provides extremely detailed information laid out in a consistent format for each DPA program in their system. Throughout the last two years, Downpaymentresource.com administrators have worked with MLO’s and the HomePrep developers to add nearly all wholesale down payment assistance programs to their platform and they didn't stop there! Extensive filters that allow for selection of specific client needs such as type (ie. SFR, manufactured homes, condos, multi-family, ADU’s), uses like renovation, above AMI income levels, non-1st time homebuyers are just a few of the filters you will find along with stand alone 2nd mortgages, combined 1st and 2nd mortgages and grants. DownpaymentResource.com is also in many MLS systems across the US and provides limited directory information and a free landing page for realtors to promote that they use DPA. Both MLO’s and realtors can subscribe to Down Payment Connect to get more of the extensive directory and back-end tools. Now, through HomePrep, HUD counselors can also use the Down Payment Connect system to filter trhough DPA programs that clients are qualified for, and can even provide wholesale programs when working with an independent loan originator (often called a mortgage broker)! Through HomePrep, HUD counselors are now able to provide MLO’s and clients with the DPA programs that they have found the client is eligible for.

HUD Counselors How To & News Articles

As federal student loan repayments resume, millions of borrowers are facing the very real risk of delinquency. Falling behind on payments can feel overwhelming, but understanding the long-term financial consequences is essential. Delinquency can trigger a chain reaction that affects your credit, career, housing, and overall financial stability.

Streamlining the Path to Homeownership: The Benefits of Using HomePrep to get Clients Mortgage-Ready

Learn how Mortgage Loan Originators (MLOs) can assist clients in overcoming credit, budgeting, and down payment challenges through HomePrep.

MLO Education

Streamlining the Path to Homeownership: The Benefits of Using HomePrep to get Clients Mortgage-Ready

Learn how Mortgage Loan Originators (MLOs) can assist clients in overcoming credit, budgeting, and down payment challenges through HomePrep.

Unique Mortgages: How To & News Articles

Affordable Programs

Streamlining the Path to Homeownership: The Benefits of Using HomePrep to get Clients Mortgage-Ready

Learn how Mortgage Loan Originators (MLOs) can assist clients in overcoming credit, budgeting, and down payment challenges through HomePrep.

Accessory Dwelling Units (ADU)

Accessory Dwelling Units (ADUs) are small, separate living spaces that are built on the same property as a single-family home. They have gained popularity in recent years as a way to provide additional housing options in urban areas. In this article, we will examine how ADUs can benefit cities, including through increased revenues, multigenerational living, vacation and rental opportunities, and increased security. ADUs Increase Revenues For Cities One significant advantage of ADUs for cities is the potential for increased revenues. Because ADUs are separate living spaces, they can be rented out to generate additional income for the property owner. This can be especially appealing for homeowners who may be struggling to afford the mortgage on their primary residence. By allowing ADUs, cities can tap into this potential new source of income and potentially increase their own revenues through property and other taxes.

Multi-family

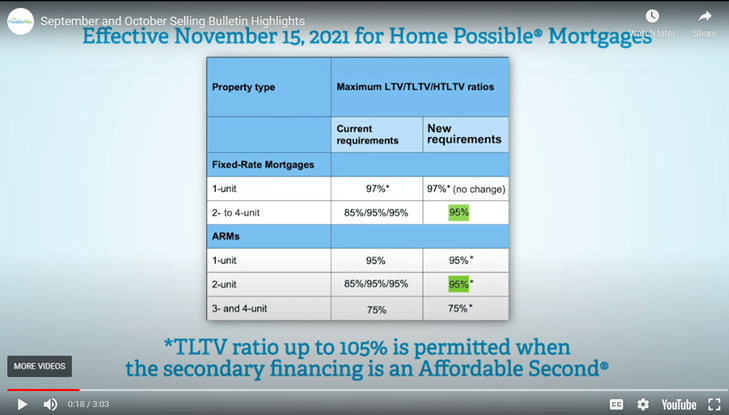

In their quest to make homes more affordable, Freddie Mac reduced the maximum loan to value (LTV) for multi-family units to 95%, a reduction of 10% down payment previously needed. Further, this financing will allow a total loan to value (TLTV) up to 105% with permitted secondary financing that is an Affordable Second.

Videos

Credit repair companies often dispute accounts to improve credit scores. Sometimes those same disputes must be removed from the credit report to receive a Fannie Mae and Freddie Mac automated underwriting system (AUS) approval. Why? Because disputes hide credit. When the dispute is removed, negative credit may return. Check with CreditXpert and use their What-If Simulator tool to see if the removal of a Dispute will affect credit scores.

When inaccurate credit exists on a credit report for mortgage delinquency, bankruptcy, foreclosure, short sale and extenuating circumstances, there are five entries that can be used in the Fannie Mae Desktop automated underwriting system (AUS). Loan originators need to know when to use these codes and where to insert them in the FannieMae.com xml loan application when needed. Entries noted below should be inputted EXACTLY AS SHOWN, with spaces (no underscores), and are case sensitive! Entry information shown for the five codes can be found in the Fannie Mae Selling Guide under B3-5.3-09, DU Credit Report Analysis (12/04/2019 ). Freddie Mac does not have a workaround code for these issues.