The mortgage industry is poised for a potential uptick in production due to a long-awaited reduction in interest rates. This presents a valuable opportunity for mortgage professionals to help clients, especially those burdened with student loans, to secure favorable mortgage terms. To fully capitalize on this, it’s crucial for loan originators to focus on three key areas: the impact of credit report changes after September 30, 2024, the benefits still available for federal student loans, and knowing the differences between federal and private loans. An example of a self-service student loan analysis tool that can be used for FREE can be found in this article.

Mortgage Loan Originators,

MLO "Do It Yourself" Solutions to Get Your Clients Mortgage Ready!

Mortgage loan originators (MLO's) often encounter pre-mortgage clients who face common obstacles that prevent them from moving forward with a mortgage.

To help clients overcome these barriers, loan originators can take one of two paths: either provide hands-on guidance and provide "Do It Yourself" resources or collaborate with HUD Counselors to ensure clients receive expert assistance tailored to their needs.

This website will help MLO's with both options.

Mortgage loan originators (MLO's) often encounter pre-mortgage clients who face common obstacles that prevent them from moving forward with a mortgage.

To help clients overcome these barriers, loan originators can take one of two paths: either provide hands-on guidance and provide "Do It Yourself" resources or collaborate with HUD Counselors to ensure clients receive expert assistance tailored to their needs.

This website will help MLO's with both options.

2 Paths of Services for MLOs and Their Clients

Path 1: MLO DIY (Do It Yourself) Solutions

Path 2: Refer Client to HomePrep with HUD Counselor

2.b., 4 and 7 not available on MLO DIY Solutions

| 7 Most Common Client Needs | Path 1: MLO DIY Solutions | Path 2: Refer Client to HomePrep with HUD Counselor |

|---|---|---|

| 1. Student Loan Repayment Plans & Default Resolution | Student Loan Repayment Plans & Default Resolution using: a. Student Debt Solutions b. LoanSense c. SAVI | Student Loan Repayment Plans & Default Resolution using HUD Counselor: a. Student Debt Solutions b. SAVI |

| 2. a.Credit Help: Short Term (0 to 6 mos) NOT CREDIT REPAIR | Credit: Short Term using: a. CreditXpert b. Score Navigator c. Meridian Link d. Short-sale credit correction through FNMA AUS | Credit: Short Term workup w/HUD counselor using: a. CreditXpert b. Score Navigator c. Meridian Link |

| 2. b.Credit Help: Long Term (7 mos to 5 yrs) NOT CREDIT REPAIR | Not Available | Credit: Long Term workup w/HUD counselor a. Debt Management (versus Debt Settlement) |

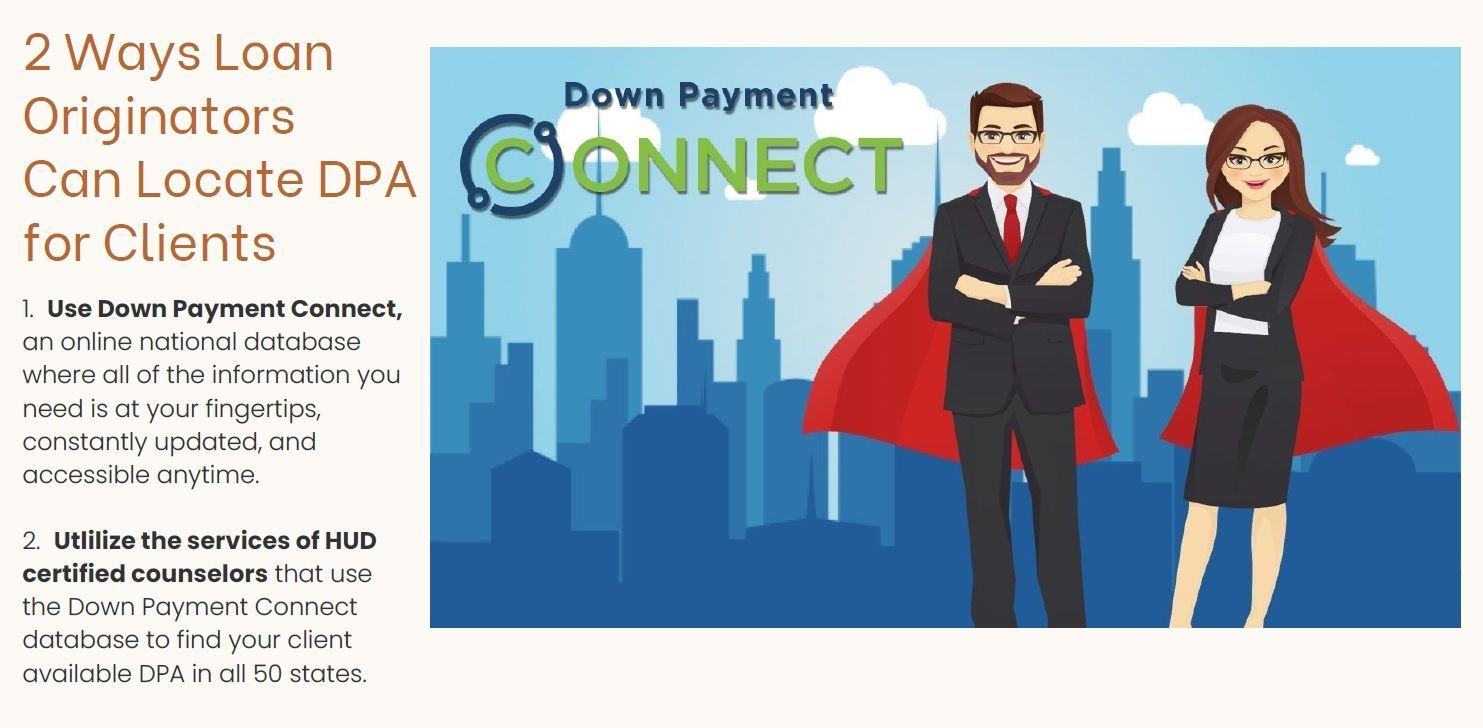

| 3. Down Payment Assistance (through Downpaymentresource.com) | Downpaymentresource.com using: a. Down Payment Connect | Workup w/HUD counselor using: a. Down Payment Connect |

| 4. Home Budgeting | Not Available | HUD Counselor does this. |

| 5. Homebuyer Education Class (HBE) | MLO’s can: a. refer to HBE | (HBE) provided by HUD counselors |

| 6. Freddie Mac Automated Underwriting System (AUS) Submission w/soft credit | Freddie Mac & Fannie Mae AUS Submission w/soft credit only if MLO’s who have this through Credit Reporting Agency. | Freddie Mac AUS Submission w/soft credit allowed for HUD counselors |

| 7. Post-Mortgage Follow-Up by HUD Counselor for 6 mo’s | Not Available | Only in HomePrep: Post-Mortgage Follow-Up with HUD Counselor for up to 6 mo’s |

"The best way to teach someone how to do it is to show them how it's done." - Unknown

The Best Resources For MLOs Assembled

MLO DIY Solutions

"How To" resources for MLOs that want to learn how to use tools that can expand education of challenges and how your client can overcome them.

Some services are FREE and some are at a cost to your client.

For more about MLO DIY Solutions, go here.

HomePrep for MLOs

MLOs refer challenged clients to HUD counselors to correct issues. When the client is "mortgage ready", the MLO is notified!

There is a cost to use HomePrep for the MLO. Some services have a cost for your client.

For more about HomePrep, go

here.

Other Resources

Articles, mortgage trade groups, mortgage advocacy, tips from industry professionals and more!

For more Resources, go here!

Disclaimer : Pamela Marron, licensed loan originator NMLS# 246438 and developer of Clients2homeowners.com, receives no compensation for any services shown on this website. This website was made for mortgage loan originators to assist clients who have challenges getting a mortgage.