Equal Housing Lender

Brokers & Bagels on Zoom

Uniting Mortgage Pros Since 2011 - Navigating Challenges, Fostering Growth & Brewing Success Together.

How Brokers and Bagels Got Started

Back in 2011 amidst the housing crisis, a unique mortgage networking group called "Brokers and Bagels" sprouted up in Clearwater, Florida. The members included independent mortgage brokers, mortgage wholesale lenders, and other mortgage professionals, all grappling to find their footing in a changing mortgage industry.

The group's popularity soared as word got out that this was the place to learn the ins and outs of the new, stricter mortgage landscape. Mortgage brokers transformed into licensed independent loan originators, and an ironic twist due to stricter mortgage regulations leveled the playing field between retail lenders and licensed mortgage broker companies with a cap on compensation.

Helping Clients Overcome Life's Hurdles

With clients still in need of homes, mortgage professionals had to navigate a complex world of helping those with life-altering events, such as divorce or job loss, which often led to damaged credit and foreclosures or short sales. And the challenge didn't end there—many mortgage colleagues found themselves in their own challenges while trying to assist clients through hurdles.

Reminiscent of past support received from Brokers and Bagels, Clients2Homeowners.com (C2H) Aims to Support Independent and Retail Mortgage Loan Originators With Ideas that Can Assist With Client Business!

The goal of Clients2Homeowners.com is to be the "go to" educational resource to independent loan originators (mortgage brokers) and retail loan originators for origination ideas. When good ideas are found that help MLOs with their mortgage business, you will see it promoted on this website!

C2Hs offers two avenues to assist loan originators:

- DIY “How To” for MLO’s.

- Home Prep, an IT platform that connects MLOs who have challenged clients to HUD counselors who can assist those clients “get mortgage ready”.

One of those origination ideas is HomePrep, an IT platform that offers 6 services for challenged clients:

1. short and long-term credit

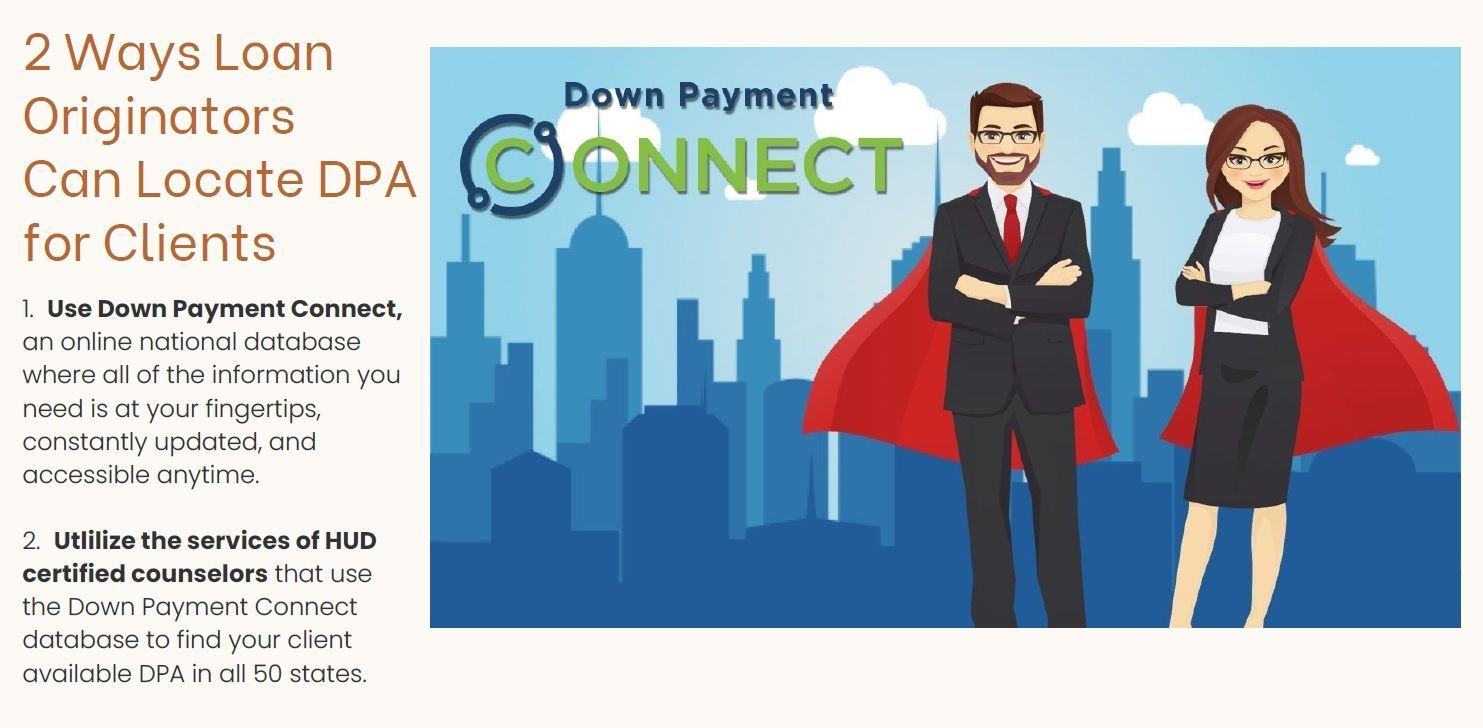

2. Down payment assistance

3. Student loan repayment plans

4. Budgeting

5. Homebuyer Classes

6. Freddie Mac HomeCoach specifically made for HUD counselors to use with a soft pull credit, and mirrors the MLO Loan Product Advisor.

When the client is “mortgage ready”, the MLO will be notified by the HUD counselor.

MLO Collaboration is WELCOME!

Collaboration between mortgage professionals that includes mortgage loan originators and mortgage industry affiliates always provides the best ideas! The mortgage landscape is changing and we mortgage industry professionals need to talk with our peers and keep our minds open to client needs. Tapping into the knowledge of mortgage industry colleagues is beneficial, especially in somewhat challenging times like these! Zoom calls will be casual with time for discussion, and questions can be emailed to info@clients2homeowners.com.

If you are a mortgage broker who would like to participate in the Home Prep pilot, please email info@clients2homeowners.com with your contact information.

####

Sincere thanks to Bryan Ehrlich, CEO and General Counsel of Innovative Mortgage Services, Inc., for starting "Brokers and Bagels" years ago. This group uplifted us and infused synergy much needed as we struggled through the housing crisis. "Brokers and Bagels on Zoom" hopes to carry on that synergy and enthusiasm again!

Home Prep Coming Soon! How To & News Articles

Streamlining the Path to Homeownership: The Benefits of Using HomePrep to get Clients Mortgage-Ready