The U.S. Department of Education allowed a 12 month “grace period” to allow student loan debtors to get restarted with their payments or to get a new repayment plan in place without any penalties for missed or late payments. That grace period ended on Sept 30th, 2024. After October 1, 2024, late or missed student loan payments can be reflected on credit reports and could affect your credit score and ability to get a mortgage. And many clients with federal student loans don't know they can still apply for student loan plans that are income driven (IDR) and that may offer loan forgiveness and cancellation. If your client needs assistance, refer them to Student Debt Solutions (SDS) where they can check out all available options for FREE. Go here for more.

MLO's: Student Loan Help for Clients

Some current facts about student loans....

- After September 30, 2024, late student loan payments were scheduled to be reported on credit reports. As of 1/1/2025, we are already seeing late payments on student loans, which can negatively impact a client’s creditworthiness and make it harder to qualify for favorable mortgage terms.

- There are millions of federal student loan holders that don't know they can still apply for repayment plans that provide more flexibility and allow Income Driven Repayment (IDR) plans that can result in lower payments, which can be particularly beneficial when preparing to purchase a home.

- Some Federal Student Loans are still eligible for income-driven repayment plans, forgiveness, and cancellation options. Plans can be changed if income reduces or to increase payments and accelerate a quicker payoff.

- Private Student Loans typically have higher, less flexible payments and do not offer forgiveness or cancellation options.

Find out about the

Student Debt Solutions tool that can help your clients that have student loans see all Repayment Plan options available to them and can make it possible for them to purchase or refinance a home.

For MLO's:

Student Loan Underwriting Criteria for all Qualified Mortgages

Conventional Freddie Mac

Freddie Mac Selling Guide : https://guide.freddiemac.com/app/guide/section/5401.2

Student loans in deferment, forbearance or repayment, including income-driven repayment plans

In all cases, an amount greater than zero must be included in the monthly DTI ratio for all student loans, as described below:

If the monthly payment amount reported on the credit report is greater than zero, the Seller must use the amount reported on the credit report, unless other documentation in the Mortgage file supports a different current payment amount greater than zero, or

If the monthly payment amount reported on the credit report is zero, the Seller must use 0.5% of the outstanding loan balance, as reported on the credit report, unless other documentation in the Mortgage file supports a different current payment amount greater than zero

For student loans in income-driven repayment plans when documentation in the Mortgage file indicates the Borrower must recertify their income and/or that the Borrower’s payment will increase prior to or on the first Mortgage payment due date, the Seller may not use the monthly payment amount described above in the DTI ratio and must instead use:

The greater of the current payment or 0.5% of the outstanding loan balance, or

The documented future payment amount if greater than the current payment, or

The future payment amount that is less than or equal to the current payment, provided that the Mortgage file contains documentation that the Borrower has recertified their income and the future payment amount has been approved. The future payment amount must be greater than zero.

Student loan forgiveness, cancelation, discharge and employment-contingent repayment programs

The student loan payment may be excluded from the monthly DTI ratio provided the Mortgage file contains documentation that indicates the Borrower is eligible or approved, as applicable, for the student loan forgiveness, cancelation, discharge or employment-contingent repayment program, and the Seller is not aware of any circumstances that will make the Borrower ineligible in the future.

Evidence of eligibility or approval must come from the student loan program or the employer, as applicable.

Additionally, the Mortgage file documentation must indicate:

There are 10 or fewer monthly payments remaining until the full balance of the student loan is forgiven, canceled, discharged or in the case of an employment-contingent repayment program, paid, or

The monthly payment is deferred or is in forbearance and the full balance of the student loan will be forgiven, canceled, discharged or in the case of an employment-contingent repayment program, paid, at the end of the deferment or forbearance period.

Conventional Fannie Mae

https://selling-guide.fanniemae.com/sel/b3-6-05/monthly-debt-obligations#P3441

Student Loans

If a monthly student loan payment is provided on the credit report, the lender may use that amount for qualifying purposes. If the credit report does not reflect the correct monthly payment, the lender may use the monthly payment that is on the student loan documentation (the most recent student loan statement) to qualify the borrower.

If the credit report does not provide a monthly payment for the student loan, or if the credit report shows $0 as the monthly payment, the lender must determine the qualifying monthly payment using one of the options below.

- If the borrower is on an income-driven payment plan, the lender may obtain student loan documentation to verify the actual monthly payment is $0. The lender may then qualify the borrower with a $0 payment.

- For deferred loans or loans in forbearance, the lender may calculate

- a payment equal to 1% of the outstanding student loan balance (even if this amount is lower than the actual fully amortizing payment), or

- a fully amortizing payment using the documented loan repayment terms.

FHA

STUDENT LOAN UNDERWRITING CRITERIA

Mortgagee Letter 2021-13 | Subject Student Loan Payment Calculation of Monthly Obligation

II.A.4.b.iv(H) Student Loans (TOTAL)

(1) Definition

Student Loans refers to liabilities incurred for educational purposes.

(2) Standard

The Mortgagee must include all Student Loans in the Borrower’s liabilities, regardless of the payment type or status of payments.

(3) Required Documentation

If the payment used for the monthly obligation is less than the monthly payment reported on the Borrower’s credit report, the Mortgagee must obtain written documentation of the actual monthly payment, the payment status, and evidence of the outstanding balance and terms from the creditor or student loan servicer.

The Mortgagee may exclude the payment from the Borrower’s monthly debt calculation where written documentation from the student loan program, creditor, or student loan servicer indicates that the loan balance has been forgiven, canceled, discharged, or otherwise paid in full.

(4) Calculation of Monthly Obligation For outstanding Student Loans, regardless of payment status, the Mortgagee must use:

• the payment amount reported on the credit report or the actual documented payment, when the payment amount is above zero; or

• 0.5 percent of the outstanding loan balance, when the monthly payment reported on the Borrower’s credit report is zero.

II.A.5.a.iv(G) Student Loans (Manual)

(1) Definition

Student Loan refers to liabilities incurred for educational purposes.

(2) Standard

The Mortgagee must include all Student Loans in the Borrower’s liabilities, regardless of the payment type or status of payments.

(3) Required Documentation

If the payment used for the monthly obligation is less than the monthly payment reported on the Borrower’s credit report, the Mortgagee must obtain written documentation of the actual monthly payment, the payment status, and evidence of the outstanding balance and terms from the creditor or student loan servicer.

The Mortgagee may exclude the payment amount from the monthly debt calculation where written documentation from the student loan program, creditor, or student loan servicer indicates that the loan balance has been forgiven, canceled, discharged, or otherwise paid in full.

(4) Calculation of Monthly Obligation For outstanding Student Loans, regardless of payment status, the Mortgagee must use:

• the payment amount reported on the credit report or the actual documented payment, when the payment amount is above zero; or

• 0.5 percent of the outstanding loan balance, when the monthly payment reported on the Borrower’s credit report is zero.

VA

VA Pamphlet 26-7, Revised Chapter 4: Credit Underwriting | pg 4-33

https://www.benefits.va.gov/WARMS/docs/admin26/pamphlet/pam26_7/ch04.pdf

g. Deferred Student Loan Payments

If student loan repayments are scheduled to begin within 12 months of the date of VA loan closing, lenders should consider the anticipated monthly obligation in the loan analysis. If the borrower is able to provide evidence that the debt may be deferred for a period outside that timeframe, the debt need not be considered in the analysis.

USDA

HB-1-3555 |CHAPTER 11: RATIO ANALYSIS |pg 11-4

7. Student loans

• For outstanding student loans, regardless of the payment status, lenders must use:

o The payment amount reported on the credit report or the actual documented payment, when the payment amount is above zero; or

o One half (.50) percent of the outstanding loan balance documented on the credit report or creditor verification, when the payment amount is zero.

• Student loans in the applicant’s name alone but paid by another party remain the legal responsibility of the applicant. The applicable payment must be included in the monthly debts.

• Student loans in a “forgiveness” plan/program remain the legal responsibility of the applicant until they are released of liability from the creditor. The applicable payment must be included in the monthly debts.

• Co-signed obligations are addressed below in section 11.

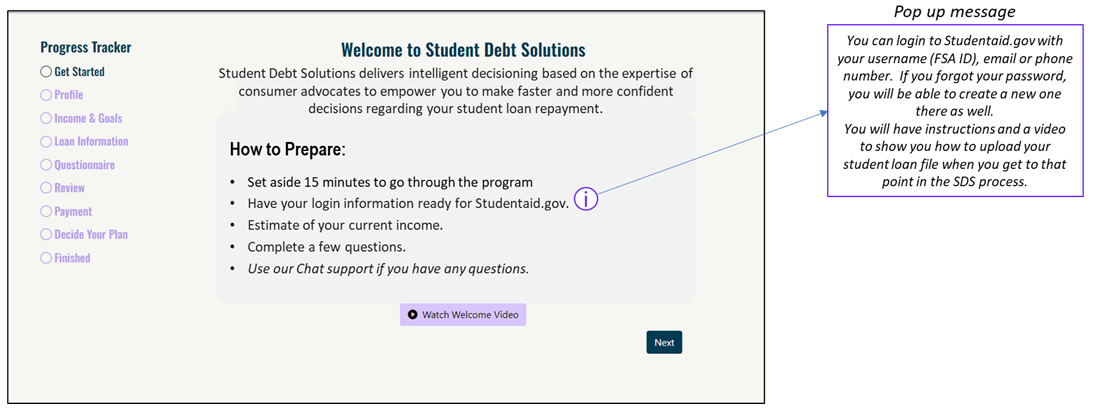

MLO's Can Help Clients With Student Loans See All Repayment Plans Available to Them Through Student Debt Solutions (SDS)!

2 Options for MLO's to Use for Clients Who Have Not Set Up Student Loan Repayment Plans Yet!

SDS Direct Solution for MLO with Clients

Who have Student Loan Help

Only Needed

If your client has federal student loans and is not already set up with a repayment plan, there is a federal government resource at Studentaid.gov.

Or, your client can go to Student Debt Solutions and get a list of all plans available to them for FREE by answering a short list of questions.

This is a good resource for a client:

- that only needs help with a student loan repayment plan or student loan default solution to get a mortgage.

- whether they need a purchase or refinance mortgage.

Use HomePrep to Connect MLO & Client With

HUD Counselor for Student Loan Help

+ 5 Other Services

Looking for additional services to SL repayment plans for clients who have other issues keeping them from getting a mortgage? Consider using HomePrep that connects the MLO and your client to a HUD counselor that will follow up with your client for needed services shown below:

- Budgeting

- Credit Help (not credit repair)

- Student Loan Repay/Default Options w/SDS

- Down Payment Assistance

- Homebuyer Education classes

- FHLMC AUS submiss. w/Soft Pull Credit

The MLO is notified when client is mortgage-ready!

How to get Student Loan File from Studentaid.gov video

Help at Studentaid.gov and Student Debt Solutions (SDS) for Repayment Plans & Defaulted Loans

"I want to figure it out myself."

There are a lot of choices if you want to manage your student loan debt on your own. The federal government provides many tools and resources on Department of Education (ED) websites like the Federal Student Aid website, Studentaid.gov. If you have a pretty straight-forward situation, it's totally doable.

Pros

- Most federal sites and federal servicers have neat tools that can help you identify your options.

- There is a ton of information available to you.

- Free!

Cons

- There is seriously a ton of information available to you. It can be overwhelming.

- Most tools and calculators focus on payments, not cancellation or forgiveness programs.

- There isn't a comprehensive tool. The tool on Studentaid.gov, for example, is "five steps or less." This barely scratches the surface of eligible options.

"I'd like to explore all of my student loan repayment options."

Student Debt Solutions (SDS) is a self-help application for clients who have student loans to find ways to reduce Student Loan monthly payments.

SDS was developed by Non-Profit Counselors with a focus on finding every option a client is eligible for, including income-based payment reduction, forgiveness, cancellation and loan acceleration.

SDS offers the ability to see all eligible plans available for FREE 1st before deciding to proceed! A cost is only incurred when the client decides to proceed. The SDS payment will provide the client with all of the forms and instructions to take action on their desired new repayment plan.

- The entire process can take approximately 60 days.

- Prior to seeing eligible repayment plan options, the client will need to have their NSLDS student loan file ID to upload for accurate student loan information.

- SDS can also provide defaulted student loan resolutions.

If a client is having a hard time getting started on their own, Consumer Debt Counselors, a HUD counseling agency that specializes in student loan debt relief, uses Student Debt Solutions to analyze federal student debt and identify all eligible options in just minutes. A HUD counselor can assist you for an additional cost.

Pros

- Cuts through the ridiculous amount of regulation quickly. Student Debt Solutions looks at over 700 different options using a recursive logic engine that filters questions that are relevant to you in about 20-25 questions.

- Recieve a customized report that identifies your eligible solutions so that you can focus your attention on making the decision that is best for you.

- Answer a group of questions and then see a list of all available options the client is eligible for for FREE. Client only pays if they want to proceed with submission paperwork for a desired plan. Client then completes and prints needed submsiion paperwork and sends to designated processing address.

Cons

- There is a cost to complete submission forms but very reasonable pricing. Cut down hours of research!

- Your report with your eligible solutions may still be overwhelming. Especially if you're in a more complex situation like a default. Chat is available and an option to work one on one with a student loan counselor is also available for an additional fee.