The mortgage industry is poised for a potential uptick in production due to a long-awaited reduction in interest rates. This presents a valuable opportunity for mortgage professionals to help clients, especially those burdened with student loans, to secure favorable mortgage terms. To fully capitalize on this, it’s crucial for loan originators to focus on three key areas: the impact of credit report changes after September 30, 2024, the benefits still available for federal student loans, and knowing the differences between federal and private loans. An example of a self-service student loan analysis tool that can be used for FREE can be found in this article.

An MLO's Shortcut to More Approvals:

Tools & Partners That Get Clients Mortgage-Ready!

Two Options to Help Clients Get Mortgage-Ready!

As a Mortgage Loan Originator, you’ve likely worked with clients who are eager to buy a home—but run into common roadblocks that delay or derail their mortgage journey.

This website introduces top-tier services designed to help your clients overcome 7 of the most common pre-mortgage challenges—and get them mortgage-ready faster.

You have two powerful options to guide your clients:

1.DIY Resources

– Give clients the tools and guidance they need to solve issues on their own under MLO DIY Solutions.

2.HomePrep

Partner with HUD-Certified Counselors with HomePrep Services – Let the experts step in to deliver personalized support and coaching with HomePrep for MLOs.

No matter which path you choose, this platform equips you with everything you need to move clients from “not ready” to “approved.”

MLO DIY Solutions and HomePrep with Andrew Mason, HUD Counselor

Whether helping clients yourself or with the help of a HUD Counselor through HomePrep, giving clients who aren't ready for a mortgage yet a path that can get them there is important.

Having solutions to assist clients with 7 common issues preventing homeownership is a "must" in every MLO's toolbox!

Whether you're an MLO that wants to assist clients yourself or you'd rather let a trained HUD Counselor assist clients that aren't mortgage ready, check out topics under MLO DIY Solutions tab or view video made by HUD Counselor Andrew Mason with NFDM.org that explains 7 services available through HomePrep for MLOs to help your clients get mortgage-ready. And when the client is ready for a mortgage, they are referred back to you.

Youtube: The HomePrep Connection

MLO DIY & HomePrep: 2 Paths of Services for Client Pre-Mortgage Help

Path 1: MLO DIY (Do It Yourself) Solutions and Path 2: Refer Client for HomePrep Services to HUD Counselor

When MLO's Should Consider MLO DIY Solutions or Refer to HUD Counselor

When to use MLO DIY Solutions

•1 or 2 DIY services for client needed.

•Short term (1-2 months) remedy.

•MLO will need to know how to refer or use services. Some services are subscription based like CreditXpert and Down Payment Connect.

•If there is cost, this is noted on service page.

1. Two MLO options to refer to HomePrep

There are two ways that MLOs can refer clients to HUD Counselors:

1: MLO uses Indisoft RxOffice platform

- MLO does HomePrep demo and signs up, uploads clients. MLO pays $100/yr. through invoice.

2: MLO emails directly to Andrew Mason, HUD Counselor

For all Clients,

MLO completes Memo of Understanding that Provides credit of $0-$300 towards clients' clos. costs if client returns to MLO for mortgage.

2. HUD Counselor will...

•Contact referred client and go over credit and budget.

•provide Action Plan with est. time client will be mortgage-ready. •communicate with client and MLO 1-2 times/mo.

•receive $99 to HomePrep from client but will provide $99 credit if HomePrep completed.

•stay in touch with referral partner on client progress.

3. Client is Mortgage Ready. MLO notified!

•HUD counselor final step: run client through FHLMC AUS w/soft credit for approval. Confirms approval & no unknown credit.

•MLO notified client is mortgage ready.

•Client is reminded that referring MLO will provide credit of $0-$300 towards clients' clos. costs.

•MLO lets referring partner know client is ready to purchase a home!

Mortgage Service Costs

3 services, the cost and what they include are listed below. A link to sign up is provided for each.

Student Debt Solutions (SDS) for Clients

The SDS platform allows clients with government student loans to see all eligible repayment plans they may be eligible for including income driven plans that can make home affordability an option! Clients use this platform for FREE and only pay a cost if they need SDS to assist to implement a desired plan! Even forgiveness and cancellation plans are still available.

Default resolution and private loan options are also available. MLO's can refer clients to SDS and HUD counselors also use SDS!

- Service is FREE unless client needs SDS help to implement plan.

- Client Pd Standard Plan: $60* and includes:

- Required Forms

- Instructions

- Automation Tools

- Expert Chat Service

- Client Pd Premium Plan: $160 and includes:

- All of the Above

- Live Counseling Session

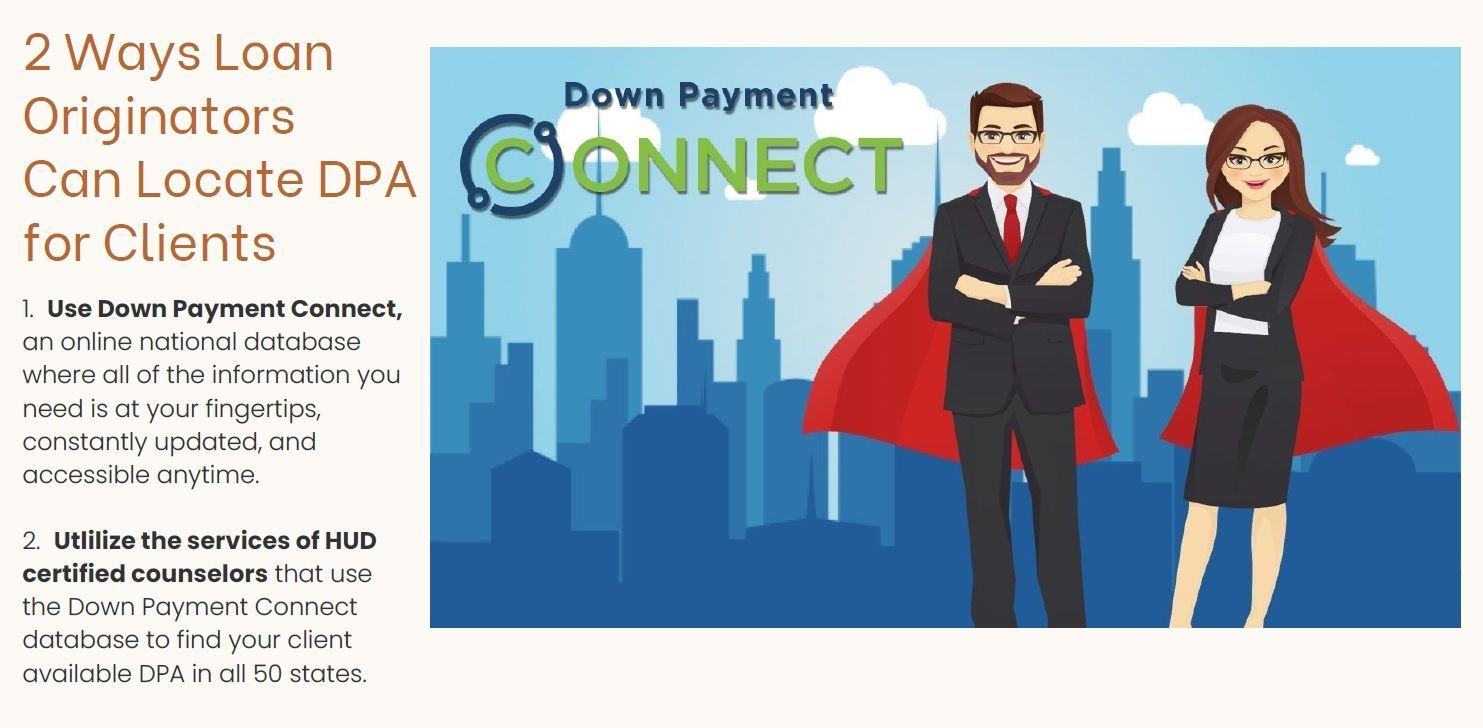

Down Payment Connect for MLO's

Down Payment Connect is used by both MLO's and HUD counselors for down payment asssitance (DPA) needs is all 50 states! Clients are paired with DPA they are qualified for based off of filters that can provide eligible programs such as community 2nd mortgages, vombined 1st and 2nd mortgages, grants and much more available for retail, wholesale and correspondent lenders.

Whether you are an individual MLO that wants to use this powerful tool to make a DPA niche for yourself, or an MLO that sends your client to HomePrep to get mortgage-ready... Down Payment Connect is by far the best tool to have in your toolbox!

MLO Pd Down Payment Connect Subscription:

- $39/mo or $390/yr ($32.50/mo) and includes:

- Personalized DPA search page for lead generation

- Directory of available DPA programs in subscribed states

- Access to detailed program guidelines

- Eligibility Lookup Tool matches clients with programs

- Program Comparison tool in Eligibility Lookup results

- Ability to keep your own notes at top of each DPA guideline

- Control which programs display for clients

- Unlimited consumer traffic to search page

- Unlimited, exclusive leads

- Generate consumer traffic reports

- Ability to display personal branding image

- Marketing resources

- Social media training

- Display NMLS ID, Branch address and real estate license number

HomePrep for MLO's and Their Clients

HomePrep provides 7 services for pre-mortgage clientsis a professional service designed to help Mortgage Loan Originators (MLOs) support clients who are not yet mortgage-ready due to credit issues, student loan debt, need for down payment assistance, budgeting help and other qualifying obstacles. Through a streamlined partnership with a certified HUD housing counselor, HomePrep connects these clients to tailored pre-mortgage readiness services—giving MLOs a reliable, trackable path to help more borrowers become eligible for home financing.

The best part? Once a client is mortgage-ready, the MLO is notified, ensuring they don’t miss out on a future loan opportunity.

- MLO Pd cost to Indisoft RxOffice for portal that provides secure online transfer of client xml 3.4 and 1003 applications, documents, HUD counselor Action Plan for client and communication between MLO and HUD counselor on clients progress. Cost is:

- $100/yr to use HomePrep portal through Indisoft

- Client Pd cost and credit to HUD Counseling agency:

- $99/per client enrolled in HomePrep.

- Once client completes work in Homeprep, they receive $99 credit back.

- Services that may be rendered:

1.Student Loan Repayment Plans & Default Resolution using HUD Counselor and Student Debt Solutions (Client Pd Costs apply)

2.Credit: Short and Long Term

3.Workup w/HUD counselor using Down Payment Connect

4.Home Budgeting

5.Homebuyer Education

6.Freddie Mac AUS submission with soft credit allowed specifically for HUD counselors

7.Six months post-mortgage HUD counseling follow-up

"The best way to teach someone how to do it is to show them how it's done." - Unknown

The Best Resources For MLOs Assembled

MLO DIY Solutions

"How To" resources for MLOs that want to learn how to use tools that can expand education of challenges and how your client can overcome them.

Some services are FREE but some are at a cost to the MLO or your client.

Costs are noted on services Home, MLO DIY Solutions and HomePrep for MLOs pages.

HomePrep for MLOs

MLOs refer challenged clients to HUD counselors to correct issues. When the client is "mortgage ready", the MLO is notified!

There is a cost to use HomePrep for the MLO. Some services have a cost for your client.

For more about HomePrep,

go here.

Other Resources

Articles, mortgage trade groups, mortgage advocacy, tips from industry professionals and more!

For more Resources, go here!

Disclaimer : Pamela Marron, licensed loan originator NMLS# 246438 and developer of Clients2homeowners.com, receives no compensation for any services shown on this website. This website was made for mortgage loan originators to assist clients who have challenges getting a mortgage.