Equal Housing Lender

Three great tools that mortgage loan originators (MLO) can use to assist clients who need help with credit, down payment assistance and student loan repayment services have been used, fine-tuned and are already in use with individual MLO’s.

These tools combined with the Freddie Mac HomeCoach automated system along with budgeting help and Homebuyer Education are all integrated in the HomePrep online platform that connects MLO’s with clients who have challenges to HUD counselors that get them mortgage ready.

For the last two years, MLO’s and developers at Indisoft, a leading provider of SaaS products, have been working on a platform that connects MLO’s who have clients that need help getting a mortgage to HUD counselors that get these clients mortgage ready. The services discussed are individually available to MLO’s. But, these services are also included in HomePrep and are provided by HUD counselors to assist clients.

All of Us Have Encountered This!

The worst problem an MLO can have is when a client is already under contract and in process…. and a problem is uncovered that threatens to unravel the whole deal! The services explained in this article take care of the most common issues that MLO’s encounter that prevent clients from getting a mortgage and are meant to be used in the pre-purchase process of getting a loan.

Whether you utilize these services individually or get the help of a HUD counselor through HomePrep, these are “must use” services to avoid issues later!

Credit Help

An issue with credit is the number one problem MLO’s encounter as the stumbling block of getting a mortgage. Credit either needs to be built, improved on or corrected. (And NO, this IS NOT credit repair!) Sometimes the issue cannot even be seen on the face of a credit report.

The best credit tool to target what can be done within a specific timeframe to improve credit scores, build credit and resolve credit issues is the CreditXpert Wayfinder and even more specifically, the CreditXpert What-If Simulator. The CreditXpert Wayfinder gives a summary with a dollar amount attached for the best possible option to improve and correct issues. The even more detailed What-If Simulator can pinpoint specific accounts and how the score can change based off of a precise account balance and the timeframe of the change. The What-If Simulator can also show how an added secured credit card can improve a credit score and is specific to the credit bureau, the balance and how long the credit must be open. Additionally, CreditXpert What-If Simulator can confirm if a dispute that needs to be taken off credit will affect credit negatively or not.

CreditXpert tools are currently available at a cost with every credit reporting agency (CRA) and is most cost effective when bundled with soft pull credit reports, where trigger leads do not exist. Check with your CRA for the best costs.

HUD counselors working on the HomePrep platform use CreditXpert tools on soft pull credits. HUD counselors even found the best secured credit cards that can be added to improve credit and provided the directions to add.

Student Loan Repayment Service

We all know that student loan forbearance ended Sept. 1, 2023 and payments restarted October 2023. But did you know that clients with student loans need to have a repayment plan in place before October 1st of 2024? Servicers can start reporting late and missed payments to the credit bureaus on Oct 1, 2024 which could have a negative impact on your clients’ credit score.

I am sure many MLOs have the experience of pre-qualifying clients who may not have brought up student loans because they aren’t paying them yet, but we see the student loans on the credit report. As we approach October 1st, 2024, there will be a scramble to get student loan repayment plans in place. Some clients have been doing this for months with various degrees of success. Some have experienced confusion or a lack of direction on what repayment plan is best for them. A major tip is stressed: DO NOT refinance government student loans. Instead, sign up for a repayment plan that can provide benefits that may still apply in the future. Even if your payment is $0, arranging for your repayment plan is imperative to do prior to October 1st.

The Student Debt Solutions (SDS) tool quickly shows a client what they can expect as a payment based off of answers to questions upfront. All payment options are shown with forgiveness, acceleration and cancellation options if available.

The client only pays for this service if they want to proceed with a repayment plan, and the cost is to complete the required paperwork (with answers to additional questions not answered prior) after which the client downloads paperwork, signs paperwork and sends paperwork in for the chosen repayment plan. SDS continues to make this service easier to use and cost effective for clients to get a repayment plan in place as soon as possible. I personally have been on Zoom calls with clients using the SDS system and it is quick, easy and questions are usually answered on the chat. If clients want more in-depth help, this can be provided for an additional cost. Bottom line: MLO’s tell clients to get a repayment plan in place NOW before the RUSH to October 1st, 2024!

The HomePrep platform is set up for HUD counselors to send clients who need student loan repayment services directly to the SDS platform. Or, those interested in this service can go directly to Student Debt Solutions here.

Down Payment Assistance (DPA)

Down payment assistance is quickly rising to the top need for clients wishing to purchase a home. Down Payment Connect, the back-end data provider for the parent Downpaymentresource.com, houses every down payment assistance program in the US and provides extremely detailed information laid out in a consistent format for each DPA program in their system.

Throughout the last two years, Downpaymentresource.com administrators have worked with MLO’s and the HomePrep developers to add nearly all wholesale down payment assistance programs to their platform. Extensive filters were added and continue to be created that allow for selection of specific client needs such as type of property like SFR, manufactured homes, condos, multi-family, ADU’s, uses like renovation, above AMI income levels and non-1st time homebuyers, even separate programs, both combined 1st and 2nd mortgages and just 2nd mortgages for wholesale lenders that independent mortgage loan originators use. These are only a few of the filters available!

DownpaymentResource.com can be found in many MLS systems across the US and provides limited directory information and a free landing page for realtors to promote that they use DPA. But MLO’s and realtors can subscribe to Down Payment Connect to get the extensive directory and back-end tools.

HomePrep HUD counselors also use the Down Payment Connect system to filter DPA programs that clients are qualified for and can even provide wholesale programs when working with an independent loan originator (often called a mortgage broker). HUD counselors provide MLO’s with the DPA programs they have found that the client is eligible for.

Added Benefits of Using HomePrep

HomePrep is not for every client looking for a home. But MLO’s will want to consider HomePrep for:

- Clients that need one or more of the services described that the MLO is not signed up for.

- Clients that have a challenge or numerous challenges that may take time some time to resolve.

- Clients that need someone to stay in touch with them on resolutions until they are completed and to notify you, the MLO, when the client is mortgage ready.

1. Freddie Mac HomeCoach

Additionally, Freddie Mac has developed an automated system called HomeCoach, a mirror of the Freddie Mac Loan Product Advisor automated underwriting system (AUS) that mortgage loan originators use. The Freddie Mac Homecoach AUS can only be used by HUD counselors, and it works with a soft pull credit, not a hard pull credit that produces trigger leads.

Sometimes, credit issues can only be found in The Fannie Mae or Freddie Mac automated underwriting system (AUS). (Specifically, which credit bureau is housing the problem can be found in credit reports that use Meridian Link, but that’s an article for another time!) The Freddie Mac HomeCoach AUS is the last service rendered to all HomePrep clients to insure that there are no other underlying problems that need to be dealt with before the client is deemed “mortgage ready”. End result: the client has already been run through one AUS submission before you get them back and you can see the findings!

2. Budgeting

All clients are required to complete a budget that is reviewed with the HUD counselor as the 1st step of HomePrep. The task of finding funds that can be used to save for down payment, to pay off debt that make ratios work or to resolve credit issues is done from the beginning by a HUD counselor upfront. And shouldn’t that be upfront anyway?

3. Homebuyer Education Class

Homebuyer education classes are commonly taught by HUD counseling agencies (HCA) and follow the National Industry Standards for Homeownership Education. These courses are 8 hours long, are offered in-person and on-line, are required by nearly all down payment assistance programs, and must be attended by at least one of the borrowers if not both needing DPA. Some Affordable conventional loans require a shorter homebuyer education class that can be done online.

Cost Analysis: Services Provided by HomePrep or Paid Individually

| Who Pays | Use HomePrep | HomePrep HUD Counselor Benefits | Use Individually |

|---|---|---|---|

| Pd by MLO | $250/yr, $15 per client | *Keeps in constant contact with client on all issues preventing home ownership. *Keeps in touch with MLO through HomePrep portal on clients’ progress. *MLO then communicates client progress to referring realtor. | N/A |

| Client Costs (pd by client) | $99/1st thru 5th session for max. total $500 for counseling duration. | *Keeps in constant contact with client on all issues preventing home ownership. *Keeps in touch with MLO through HomePrep portal on clients’ progress. *MLO then communicates client progress to referring realtor. | N/A |

| CreditXpert tools (pd by MLO) | Included | *Utilizes CreditXpert tools Wayfinder and What-If Simulator to increase credit scores, resolve derogatory credit, build credit where none or more is needed, remove disputes and distinguish which credit bureau is causing issue thereby avoiding costly Rapid Rescores. *HUD approved credit counselors can also provide long-term Debt Management. | Bundled cost (included on every soft pull credit pulled) varies per credit reporting agency |

| Student Debt Solutions (SDS) (pd by client) | $49.50/client thru 4/30/24, then $99/client | *Automatically directs with integration to SDS to set up repayment plan. *Inserts repayment plan into debt load for ratios. | $49.50/client thru 4/30/24, then $99/client |

| Down Payment Connect (pd by MLO) | Included | *Provides available DPA programs statewide, can provide in all 50 states | $39.99/mo./per state. Discount for pd. yearly. |

| HomeCoach AUS (no cost) | Included | *Runs client through HomeCoach, makes sure no uncovered issues *If issue, corrects before releasing client to MLO | Freddie Mac, Fannie Mae AUS |

| Budgeting (pd by client) | Included | *Finds any additional fund opportunities to save monies, correct credit. | N/A |

| Homebuyer Education Class (pd by client) | Included | *Often provides free of charge. | Cost required by provider |

| Memorandum of Understanding (MOU) credit towards clients clos costs (pd by MLO) | $0 to $300/per client | *Credit between $0 to $300 is paid towards clients closing costs if the client returns to the referring MLO for their mortgage. Credit is meant to assist client for funds they paid upfront for HUD counselor services in HomePrep. | $0. However, MLO pays for CreditXpert costs and Down payment Connect subscription. |

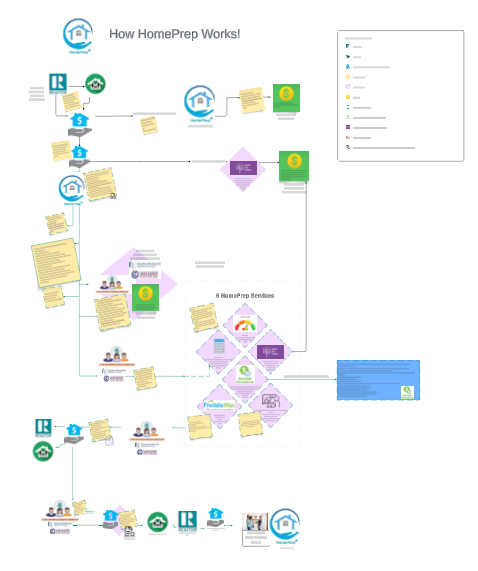

Want to better understand the HomePrep Workflow?

Try out our interactive chart and see each step of the process for you and for your clients.

MLO’s: What’s Your Time Worth?

Though we are optimistic about a few decreases in interest rates this year, many of us are seeing more clients who need extra attention to issues that are still hanging on since Covid. And with the lower housing inventory that is available, clients need to be very prepared and ready to purchase a home. Client issues need to be resolved in order to take advantage of some of the best programs the mortgage industry has seen in years and be poised to partake of an abundance of down payment assistance now available.

Clients with NO issues are not the norm at present. Even well qualified clients with pretty good credit are in need of down payment assistance and lower student loan payments to afford today’s higher priced homes.

Use HomePrep and HUD counselors to work with clients who need more attention than you are able to give right now. Or, get the services we’ve explained in this article but know them inside and out to use them well. HomePrep was made to give you the off ramp to send clients that need more time than you can offer and keep your mortgage business constant.